In a shocking insurance revelation that has left a family reeling, a mother-of-three discovered the hard way that her Asda car insurance policy contained a devastating gap in coverage after a serious accident.

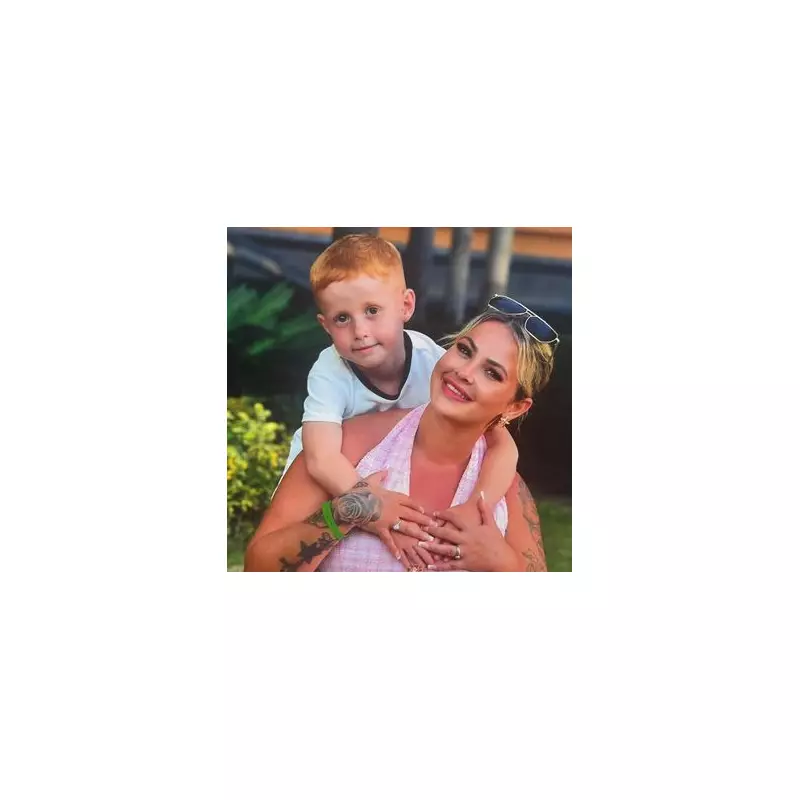

Kelly Burgess, 38, from the West Midlands, found herself facing financial ruin when her beloved Vauxhall Zafira was written off following a collision. To her absolute horror, she learned that her comprehensive policy with Asda Insurance didn't include coverage for her own vehicle - a critical detail she claims wasn't made clear when she purchased the policy.

The Moment Everything Changed

"I was absolutely devastated," Kelly recounted, her voice trembling with emotion. "When that phone call came through and they said they wouldn't be paying out for my car, my whole world collapsed. I felt physically sick."

The family's main mode of transport, essential for school runs, work commitments, and daily life, was suddenly gone. Worse still, they were left facing a staggering £7,000 financial black hole with no means to replace their vehicle.

A Costly Misunderstanding

Kelly had been paying £97 monthly for what she believed was comprehensive coverage. "I specifically asked for comprehensive insurance because I wanted that peace of mind," she explained. "At no point did anyone explain that this particular policy didn't cover damage to my own car."

The distraught mother now faces the impossible task of balancing essential family expenses with the need to fund a new vehicle, all while dealing with the emotional trauma of the accident itself.

Insurance Industry Warning

This case highlights a critical issue facing many UK drivers: the fine print in insurance policies that can leave consumers dangerously exposed. Insurance experts warn that policyholders should always:

- Carefully review policy documents before signing

- Ask specific questions about what is and isn't covered

- Compare multiple quotes and coverage levels

- Seek clarification on any confusing terminology

Kelly's message to other drivers is stark: "Don't make the same mistake I did. Read every word, ask every question, and make absolutely sure you understand what you're paying for. This nightmare has turned our lives upside down."

Asda Insurance has faced criticism for the clarity of their policy documentation, raising questions about whether consumers are being adequately informed about coverage limitations.