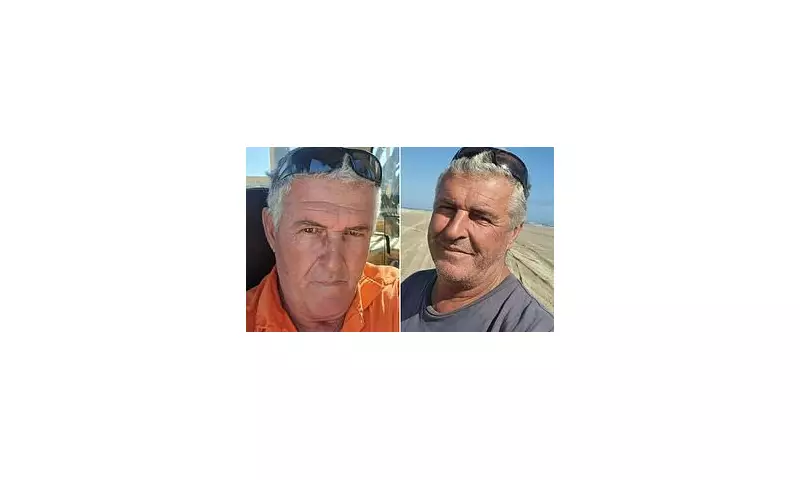

In a revelation that has sent shockwaves through Australia's financial sector, a single mining worker's retirement fund has grown to an astronomical £1.6 billion, highlighting what experts are calling a "staggering disparity" in the nation's superannuation system.

The Billion-Dollar Retirement Account

While most Australian workers diligently contribute to their superannuation funds hoping for comfortable retirement, one mining magnate's retirement savings have reached unprecedented levels. The enormous sum, equivalent to the combined retirement savings of thousands of ordinary Australians, has raised serious questions about equity and fairness in the country's pension system.

How Did This Happen?

Financial analysts suggest this extraordinary accumulation resulted from a perfect storm of factors:

- Decades of shrewd investment strategies within the superannuation fund

- Exceptional performance of mining sector investments

- Favorable tax arrangements available to large retirement funds

- Compound growth over an extended period

Industry Experts Sound the Alarm

Retirement policy specialists have expressed deep concern about what this case reveals about Australia's superannuation landscape. "When one individual's retirement fund surpasses the wildest dreams of thousands of hard-working Australians, we must examine whether the system is working as intended," noted one leading economist.

The case has prompted calls for greater transparency and potential reform in how retirement funds are managed and distributed across different income brackets.

Broader Implications for Australian Workers

This extraordinary example comes at a time when many Australians are increasingly anxious about their retirement prospects. With rising living costs and economic uncertainty, the contrast between this billion-pound fund and the average worker's superannuation balance could not be more striking.

Financial regulators are now examining whether current superannuation laws adequately address such extreme accumulations and whether reforms might be necessary to ensure the system remains equitable for all Australians approaching retirement age.