The UK economy has been dealt a significant blow as new data reveals the private sector's sharpest contraction in nearly a year, presenting Chancellor Rachel Reeves with mounting challenges ahead of her first major budget announcement.

Economic Storm Clouds Gather

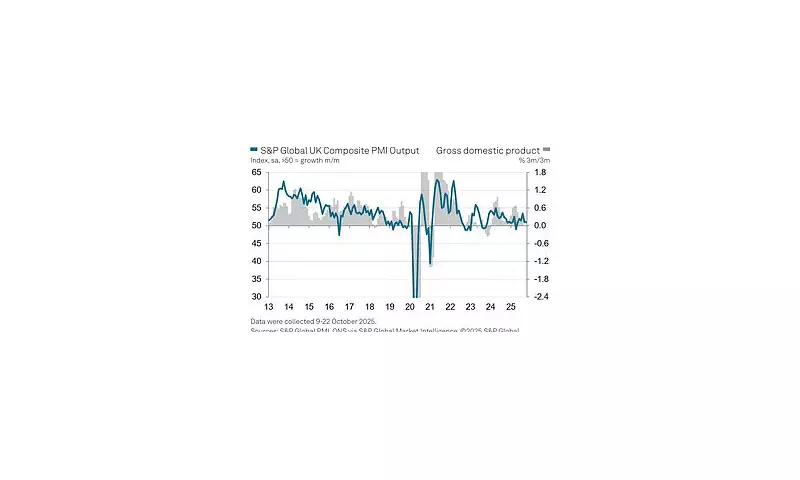

According to the closely-watched S&P Global/CIPS UK Composite PMI, the preliminary reading for September plummeted to 46.6, marking the lowest point since November 2023. This critical indicator has now languished below the 50.0 threshold for three consecutive months, signalling sustained contraction across both manufacturing and services sectors.

Manufacturing Takes Biggest Hit

The manufacturing sector experienced the most severe downturn, with its PMI reading collapsing to 45.4 - a staggering 2.5-point drop from August's figures. This represents the fastest rate of decline in the goods-producing sector since May 2020, during the height of pandemic restrictions.

Key findings from the report reveal:

- New orders falling at accelerated pace

- Business confidence hitting seven-month low

- Employment declining for first time in 2024

- Input cost inflation remaining elevated

Services Sector Struggles

The dominant services sector didn't fare much better, registering a PMI of 47.2. While this represented a slight improvement from August's 47.0, it still indicates contraction for the third straight month. The marginal improvement offers little comfort against the broader economic backdrop.

Political Pressure Mounts

Chancellor Rachel Reeves now faces immense pressure to stimulate growth in her upcoming budget announcement. The Labour government, which came to power promising economic stability and growth, must now confront the reality of a stalling economy.

"These figures present a sobering picture of the challenges facing the UK economy," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "The simultaneous decline in both manufacturing and services suggests broad-based weakness that will require careful policy response."

Employment and Inflation Concerns

Perhaps most worrying for policymakers is the first decline in employment recorded this year, suggesting businesses are beginning to retrench in response to weakening demand. Meanwhile, input cost inflation remains stubbornly above pre-pandemic averages, squeezing profit margins and complicating the Bank of England's inflation fight.

The combination of falling output, declining employment, and persistent cost pressures creates a perfect storm for economic policymakers, who must balance growth stimulation with inflation control in an increasingly challenging global environment.