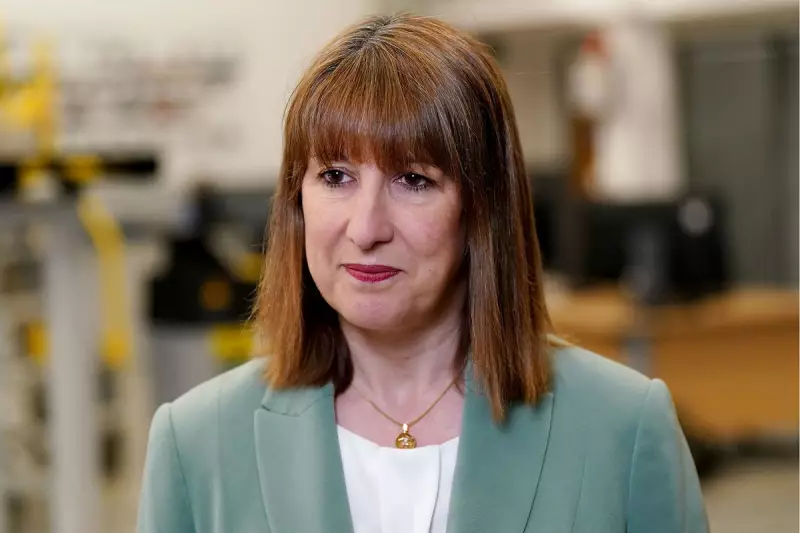

Chancellor Rachel Reeves is reportedly exploring the introduction of a wealth tax aimed at non-domiciled residents, a move that could generate significant revenue for public services and economic initiatives.

The proposal, which targets wealthy individuals who live in the UK but claim tax residency elsewhere, has sparked debate among policymakers and economists. Supporters argue it would ensure a fairer tax system, while critics warn it could deter high-net-worth individuals from investing in the UK.

Why a Wealth Tax on Non-Doms?

Non-domiciled residents, or "non-doms," currently benefit from favourable tax arrangements, allowing them to avoid UK taxes on overseas income. Reeves' plan would close this loophole, potentially raising billions to fund healthcare, education, and infrastructure.

Potential Economic Impact

Proponents claim the tax could redistribute wealth more equitably and reduce the burden on middle-income earners. However, opponents argue it might drive wealthy entrepreneurs and investors abroad, harming the UK's competitiveness.

With public finances under strain, the debate over taxing non-doms is likely to intensify in the coming months as the government seeks sustainable revenue streams.