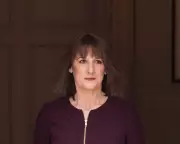

Reeves extends tax freeze, hitting millions of Britons

Chancellor Rachel Reeves extends tax threshold freeze until 2030-31, dragging 5.2M more into income tax. Discover how this stealth raid impacts your finances and why it breaks manifesto promises.