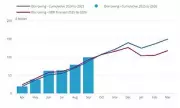

Gilt yields surge as Chancellor Reeves abandons income tax rise

UK government borrowing costs jump as Rachel Reeves reportedly scraps income tax hike plans, breaking Labour manifesto pledge. Gilt yields surge in market sell-off ahead of November 26 Budget.