As autumn fades into winter, Britain faces a familiar yet increasingly dangerous reality: rising waters swallowing towns, overwhelming infrastructure, and threatening communities while political attention remains conspicuously absent.

The Forgotten Floods

While Storm Claudia recently dominated headlines after battering the Welsh border town of Monmouth, where rescue operations saved residents from rising waters and drones captured buildings transformed into islands within a clay-brown swamp, numerous other flood events have passed with little national attention.

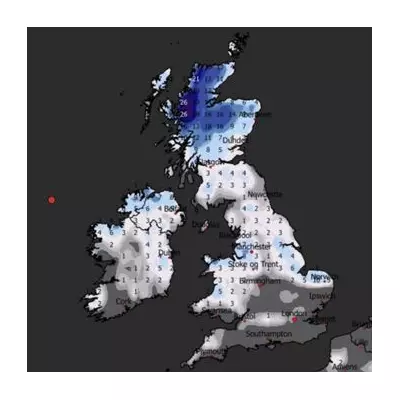

Just eleven days before Claudia's arrival, Cumbria experienced submerged roads and over 250 flood-related incidents reported to local councils. Railway lines in Cornwall disappeared underwater, while Carmarthen in west Wales witnessed what locals described as the worst flooding in living memory.

These events, though devastating for affected communities, now seem too commonplace to warrant sustained national coverage, creating a dangerous normalisation of Britain's escalating water crisis.

The Gathering Storm

Recent research paints an alarming picture of Britain's flood-threatened future. Insurance giant Aviva's October report, Building Future Communities 2025, revealed that one in 13 new homes built over the past decade sit in highest-risk flood zones.

The projections grow even more concerning: by 2050, the number of properties facing flood risk could increase by 25% to 8 million nationwide. Some communities already face the stark reality of this future, with the Worcestershire town of Tenbury Wells seeing its civic buildings become uninsurable after four major floods in just six years.

Academic experts highlight years of underinvestment in flood defences, despite the government allocating £10.5 billion for improvements through 2036. They emphasise the overlooked value of natural protections like expanded wetlands, new forestry, and greener urban environments.

Insurance Crisis and Economic Collapse

Professor Jess Neumann from the University of Reading warns that current infrastructure planning meets today's standards but fails to prepare for the extreme weather expected by 2070 or 2080.

The insurance landscape reveals another layer of crisis. In areas with high flood risk, 58% of retail spaces and 50% of offices operated without insurance coverage in 2022, often because premiums became unaffordable or coverage excluded business interruption losses.

Professor Neumann expresses concern about local economies hollowing out as flooding worsens: "Businesses will leave, and places might fall into deprivation."

The Flood Re scheme, which currently makes coverage affordable for homeowners in high-risk areas, will cease in 2039, returning the market to "fully risk reflective pricing" that could render some locations simply uninhabitable.

"Nobody's putting pins in the maps and saying, 'these are places that we think will become uninhabitable,'" Neumann notes. "But I think in the next five or 10 years, it'll become clear where those places are."

Impossible Choices Ahead

Dr Carola Koenig from Brunel University's Centre for Flood Risk and Resilience presents an even starker assessment: "At some point, some hard decisions have to be made – that certain communities will have to be relocated. Protection becomes so expensive that it's not worth it, so you have to move communities to safer, higher ground."

This prospect collides with political reality in a system filled with climate denial and cynicism, raising questions about the massive public spending required and the current political silence surrounding these inevitable challenges.

Professor Neumann contrasts Britain's approach with countries facing earthquake threats, where public education and preparedness are standard: "Our greatest natural hazard is flooding, and we don't prepare people for it."

This failure to confront reality leaves Britain sleepwalking into a future where flash floods can occur anywhere, not just in traditional floodplain areas, threatening communities unprepared for the rising waters already at their doors.