Millions of O2 customers are facing an unwelcome financial blow as the telecom giant prepares to implement significant price hikes this spring. The increases, tied to the Retail Price Index (RPI) rate of inflation plus an additional 3.9%, could see bills rise by nearly 10% for many loyal customers.

What's Changing For O2 Customers?

From April 2024, O2 will apply its annual price adjustment to most monthly mobile contracts. The calculation uses December 2023's RPI figure of 5.3%, then adds the extra 3.9% premium, resulting in a substantial 8.7% increase to monthly bills.

This means a customer paying £30 per month could see their bill increase by approximately £2.61 monthly, adding over £31 to their annual mobile costs.

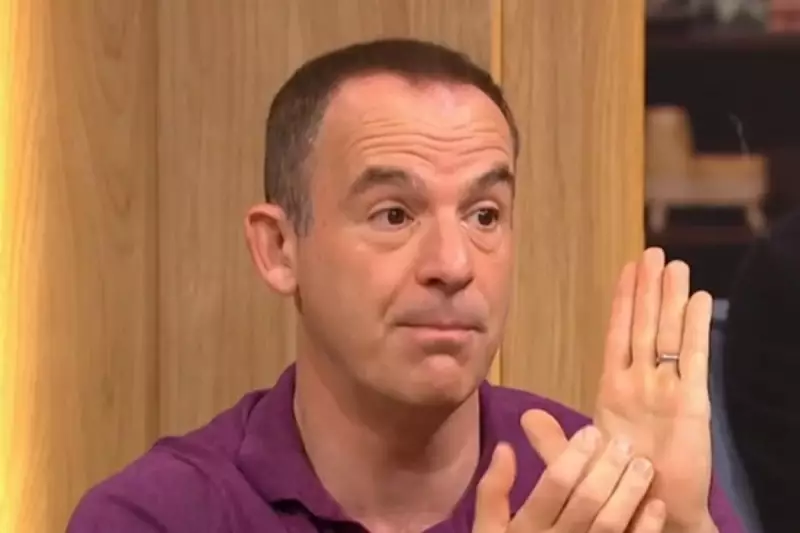

Martin Lewis Weighs In On Consumer Rights

Consumer champion Martin Lewis has clarified the situation for concerned mobile users. While new Ofcom rules coming into effect will protect customers from unexpected mid-contract price rises, they won't help those already trapped in contracts with inflation-linked terms.

"The crucial distinction," explains Martin Lewis, "is that if your contract started after these rules were announced, you're protected. But if you're in an existing contract with these terms, you're likely stuck."

Your Escape Routes Explained

Despite the grim news for many, there are potential ways to avoid these price increases:

- Check your contract date: Contracts starting after June 2022 may offer more protection under new transparency rules

- Look for notification errors: If O2 failed to properly notify you about price rise terms, you might have grounds to leave without penalty

- Consider switching: Even if you can't escape penalty-free, calculating whether paying the exit fee saves money long-term could be worthwhile

Why Ofcom's New Rules Won't Help Existing Customers

The upcoming Ofcom regulations, while welcome for future protection, highlight a gap in consumer safeguards. The rules require providers to clearly state potential price increases in pounds and pence rather than linking them to unpredictable inflation metrics.

However, this protection only applies to contracts taken out after the rules were formally announced, leaving millions of existing customers vulnerable to these substantial hikes.

As Martin Lewis's Money Saving Expert team emphasises, the key takeaway is to always check contract terms carefully before signing and to understand exactly what any inflation-linked clauses might cost you in reality.