In a seismic shift for Middle Eastern football, Saudi Arabia's sovereign wealth fund has announced plans to privatise four of its biggest football clubs, including Cristiano Ronaldo's current team Al-Nassr. The move represents the latest phase in the kingdom's ambitious strategy to become a global sporting powerhouse.

The Public Investment Fund (PIF), which holds majority stakes in the clubs, revealed that Al-Nassr, Al-Hilal, Al-Ittihad, and Al-Ahli will be transformed into companies capable of attracting private investment. This radical restructuring aims to accelerate the development of the Saudi Pro League and enhance its commercial appeal worldwide.

The Ronaldo Effect: Superstar Impact on Valuation

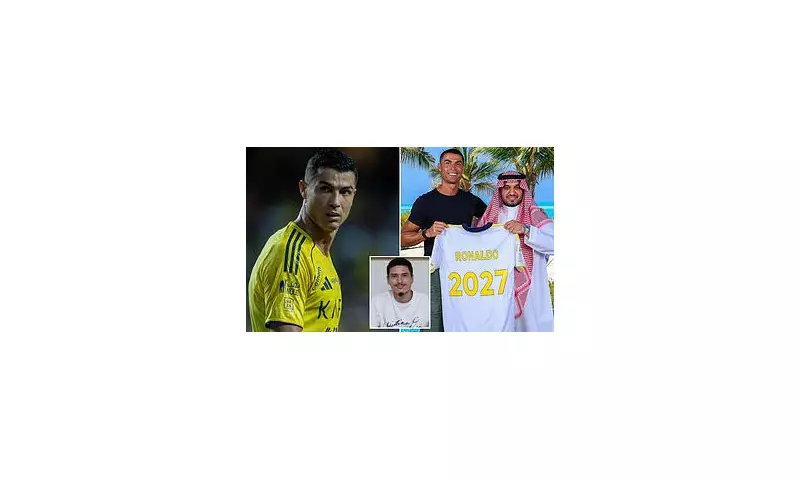

The presence of global icon Cristiano Ronaldo at Al-Nassr has undoubtedly increased the club's international profile and commercial potential. Since his headline-making arrival in December 2022, the Saudi league has attracted numerous other elite players including Karim Benzema, Neymar, and N'Golo Kanté.

This influx of talent has dramatically increased global viewership and commercial interest in Saudi football, making the timing of this privatisation initiative particularly strategic. The PIF clearly aims to capitalise on this heightened international attention.

Vision 2030: Football as Economic Catalyst

This initiative forms a crucial part of Crown Prince Mohammed bin Salman's Vision 2030, which seeks to diversify the Saudi economy beyond oil. The sports sector, particularly football, has been identified as a key driver for tourism, investment, and soft power influence.

The privatisation model mirrors approaches taken with other PIF-owned enterprises such as Saudi Aramco, suggesting the government views football clubs as serious commercial assets rather than mere sporting institutions.

What This Means for Global Football

The Saudi Pro League's transformation could have far-reaching implications for the global football landscape:

- Increased financial competition for European leagues in player acquisitions

- New investment opportunities for international consortiums and wealthy individuals

- Enhanced commercial partnerships with global brands seeking Middle Eastern market access

- Potential changes in how football clubs are valued and operated worldwide

While the announcement confirms the initial four clubs involved, industry analysts suggest this could be the beginning of a wider transformation of Saudi football's ownership model. The coming months will likely reveal more details about investment opportunities and the specific criteria for potential investors.

This move positions Saudi Arabia not just as a destination for aging stars seeking lucrative contracts, but as a serious emerging market with ambitions to compete with established European leagues both on and off the pitch.