In a dramatic financial manoeuvre that has sent shockwaves through the football world, Sir Jim Ratcliffe and his INEOS group have tabled a bold £245 million investment proposal for Manchester United. The controversial plan, which would see the British billionaire inject fresh capital directly into the club, represents a significant departure from traditional football financing structures.

The proposed investment, revealed through meticulous document analysis, would be structured through a share issue that remarkably excludes the majority of the club's current shareholders. This unconventional approach has raised eyebrows among financial experts and supporters alike, creating a complex narrative around the future ownership of the iconic football institution.

The Financial Architecture Behind the Deal

Ratcliffe's proposal outlines a sophisticated financial arrangement where INEOS would acquire these newly issued shares at a price of $33 each. This strategic move would effectively increase their stake in the club while simultaneously providing immediate capital injection. The mechanics of this deal demonstrate a shrewd understanding of corporate finance, but also present potential challenges in terms of shareholder equity and club governance.

Financial analysts examining the proposal have noted that this structure allows Ratcliffe to consolidate his influence without triggering a mandatory full takeover bid, maintaining a delicate balance between investment and control.

Glazer Family's Calculated Position

The Glazer family, Manchester United's controversial owners since 2005, find themselves in a particularly advantageous position under this proposed arrangement. As major shareholders, they would retain their existing stakes without needing to contribute additional funds, while simultaneously seeing the club's financial health improve through the substantial cash injection.

This aspect of the deal has drawn criticism from some quarters of the investment community, with concerns raised about the potential dilution of other shareholders' interests and the precedent it sets for future football club financing.

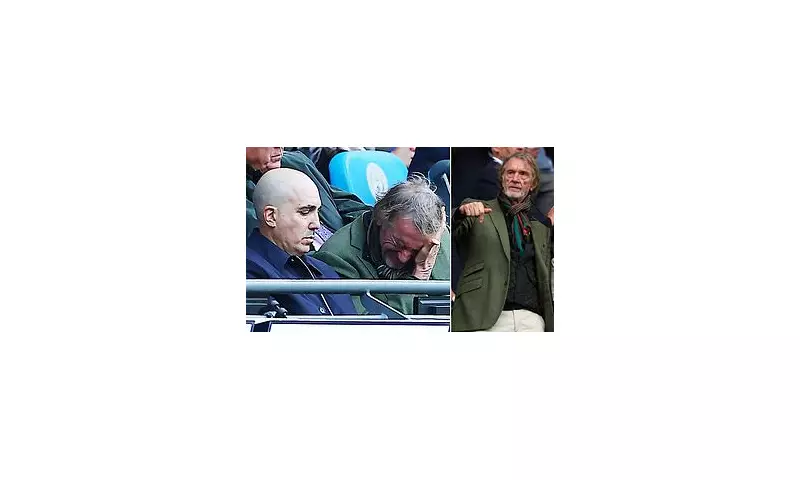

Fan Reactions and Broader Implications

The Manchester United supporter community has met the proposal with mixed reactions. While many acknowledge the urgent need for capital investment in stadium infrastructure and playing squad enhancement, others express concern about the long-term implications of such unconventional financial engineering.

Football finance experts highlight that this move could establish a new paradigm for club ownership structures in the Premier League, potentially influencing how other wealthy investors approach football club acquisitions in the future.

The Road Ahead: Regulatory Hurdles and Approval Process

The proposed investment faces several significant hurdles before implementation. Premier League regulations, financial fair play considerations, and shareholder approval processes all present potential obstacles that must be navigated carefully.

Industry observers suggest that the coming weeks will be crucial in determining whether this innovative approach to football club investment will gain the necessary approvals, setting the stage for what could become a landmark case in sports business management.