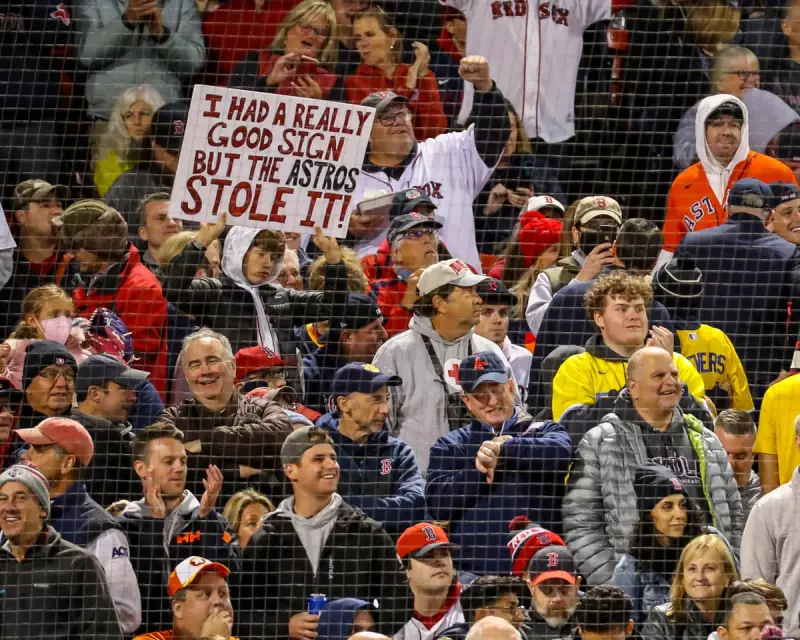

Jeff Luhnow's spectacular fall from baseball grace has become the foundation for an ambitious new venture in world football. The former Houston Astros general manager, who was dismissed following Major League Baseball's severe sanctions in the sign-stealing scandal, has completely reinvented himself as a football club owner with global aspirations.

From American Disgrace to European Ambition

Luhnow's departure from baseball wasn't voluntary. He was suspended and subsequently fired by the Astros after the organisation was found to have illegally stolen signs during their 2019 season, in what constituted one of the most severe punishments in North American professional sports history. The architect of what became known as "Extreme Moneyball" - a data-driven approach that brought three World Series championships to the Astros and St Louis Cardinals - found himself at career crossroads.

Six years later, Luhnow reflects on the scandal with perspective. "It was about trying to read the signs between the catcher and the pitcher," he explains. "The way our club did it during that particular season was against the rules, and since I was the general manager, I was held responsible for it." Rather than dwelling on what many would consider a career-ending event, Luhnow now sees it as "a blessing in disguise" that pushed him toward his next challenge.

Building a Football Empire with Data-Driven Philosophy

Luhnow has transferred his analytical approach from baseball diamonds to football pitches through his company Blue Crow Sports Group. The organisation boasts an impressive roster of investors, including former baseball star Alex Rodriguez, and has been building a network of clubs that currently includes Leganés in Spain and French Ligue 1 side Le Havre, one of France's oldest clubs renowned for producing talents like Paul Pogba and Riyad Mahrez.

The connection to football wasn't entirely new for Luhnow. He reveals he'd already been "getting the itch to do something else" after 16 years in baseball and had begun exploring football investments. Conversations with Billy Beane - the Oakland Athletics executive whose sabermetrics strategy inspired Moneyball and who now has interests in Barnsley and Dutch side AZ - convinced Luhnow to take the plunge into the beautiful game.

Revolutionising African Talent Development

The cornerstone of Luhnow's football strategy mirrors his baseball philosophy: identify undervalued talent markets and create efficient pathways to top-level competition. For European football, he's identified Africa as the prime territory for this approach.

"It was pretty clear from the beginning that Africa was going to be the best place for us to find talent that we can integrate into our European clubs," Luhnow states. He draws parallels to baseball, where "a disproportionately large portion of talent comes from places like the Dominican Republic and Venezuela."

The infrastructure challenges in Africa are significant, with Luhnow noting that "young athletes in Africa don't have the benefits that young athletes in Europe or North America have." However, he believes the talent potential outweighs these obstacles. Through recruitment and development programmes established in several African countries including Ghana and Zambia over the past five years, Blue Crow is building what Luhnow hopes will become a reliable talent pipeline.

The early success story that validates this approach is Yan Diomande, an 18-year-old from Ivory Coast who joined Leganés last year. After making just 10 appearances for their first team, the youngster was sold to RB Leipzig for €20 million (£17.4 million) this summer, having been linked with European giants Paris Saint-Germain and Real Madrid after an impressive end to the season.

"We've got more players like that in our pipeline," Luhnow reveals confidently. "We expect to not only have once in a while those types of successful outcomes; we expect to make it an annual event."

Ambitious Plans for European Clubs

With Dubai-based investment firm 885 Capital acquiring a majority share in Blue Crow this year, Luhnow's multi-club model has additional financial muscle to pursue its African talent vision. 885 Capital's chief executive Sudeep Ramnani emphasises that their approach goes beyond mere talent identification: "We don't just want to focus on talent, but also personality development - often you get some great talent that fails because maybe they just haven't had that exposure to the developed world early enough."

For Le Havre, Luhnow has particularly ambitious plans to connect with British fans, noting the club's historical ties. "We want to make Le Havre every English person's second favourite team or favourite team in France, because we were founded by Oxford and Cambridge students," he says. "We're the closest major city to England and we should be every British person's favourite team in France. That's our goal."

Despite scepticism from some Leganés supporters about being part of a multi-club network, especially following their relegation from La Liga last season, Luhnow remains undeterred. He draws motivation from the unique emotional rewards that sports provide compared to his previous career in business and technology.

"My most satisfying moments in sports have been the World Series parades in St Louis and Houston," he reflects. "The first championship ever in Cancún, we won and took the trophy through town and just seeing people so excited. And then here at Leganés, when we got promoted to the first division a couple of years ago, it's a town of 200,000. We went to the main square; there were 75,000 people there. People were crying."

He concludes with conviction: "You can't get that in business and technology. You can only get that in sports, and that's what drives me. So I really appreciated my time in baseball. I love it. I still am involved, talking to people. I track it. But football is where I need to be right now."