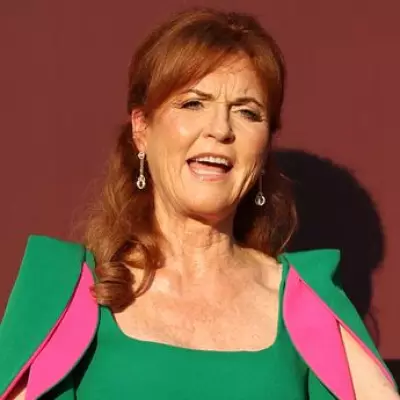

Shadow Chancellor Rachel Reeves has signalled that the state pension triple lock may no longer be sustainable, urging the government to conduct an independent review into its long-term affordability.

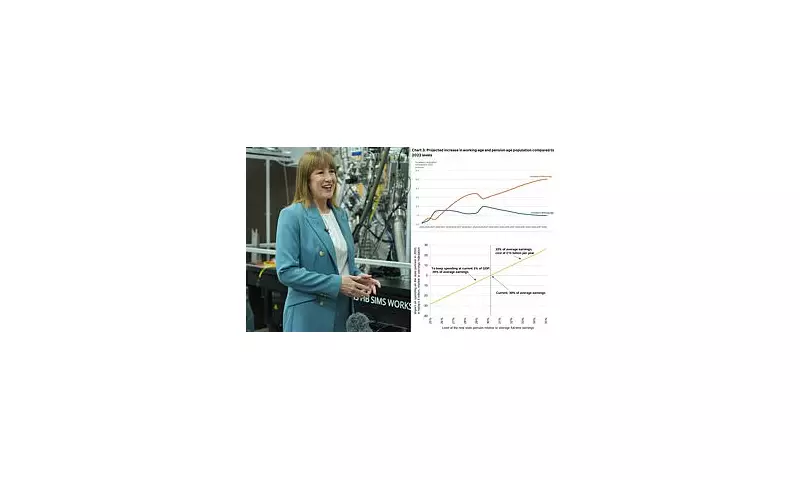

In a striking intervention, the Labour frontbencher warned that the policy – which guarantees annual increases to the state pension by the highest of inflation, average earnings growth, or 2.5% – could become unaffordable as Britain's ageing population places growing pressure on public finances.

Pension Time Bomb Looms

Speaking to journalists, Reeves stressed: "We need an honest conversation about the sustainability of pensions. The triple lock was right when introduced, but we must ensure pensions remain affordable for future generations."

Her comments come as:

- The state pension bill has ballooned to over £100 billion annually

- Britain's ratio of workers to pensioners continues to decline

- Some economists warn the triple lock could add £45 billion to pension costs by 2050

Political Hot Potato

The triple lock has become a political sacred cow since its introduction in 2010, with both Conservative and Labour leaders reluctant to propose reforms despite growing fiscal concerns. Reeves' intervention marks the first significant break in this consensus.

Experts warn: Maintaining the triple lock in its current form could require either higher taxes, increased retirement ages, or cuts to other public services.

What Could Change?

Possible reforms being discussed include:

- Replacing the 2.5% floor with a lower minimum increase

- Linking rises to average earnings only

- Introducing means-testing for pension increases

- Raising the state pension age more rapidly

The debate comes as the Office for Budget Responsibility warns that pension spending could rise from 5.4% to 8.1% of GDP by 2070 without reform.