Swansea Pensioner Convicted for £70,000 Benefits Fraud Despite Owning Overseas Property

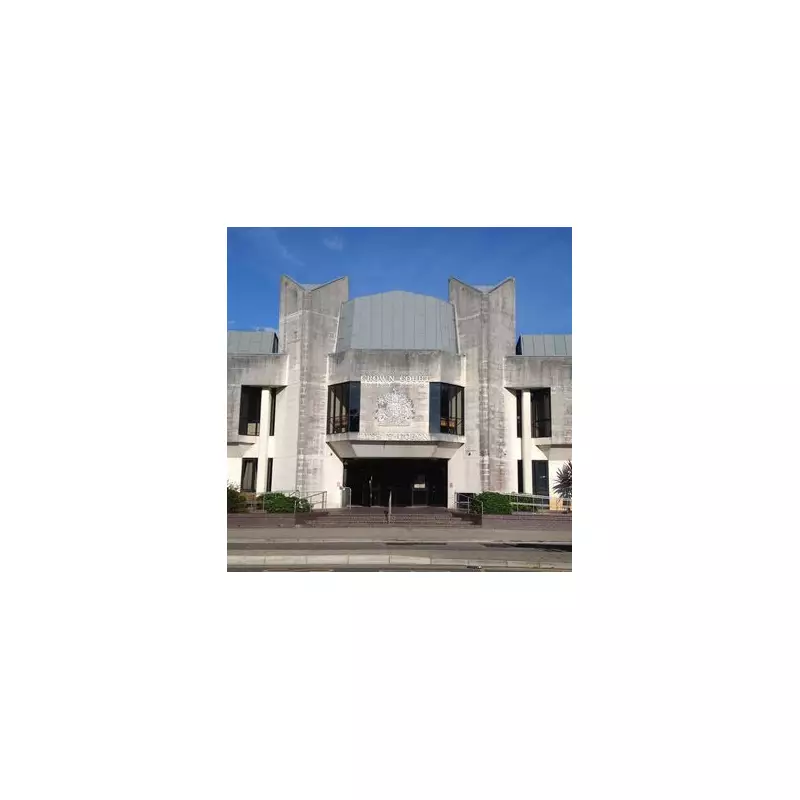

A 75-year-old man from Swansea has been convicted of fraudulently obtaining more than £70,000 in taxpayer-funded benefits while failing to declare significant assets, including a holiday home abroad. George Tatlow admitted to three counts of dishonestly claiming state support during a hearing at Swansea Crown Court.

Substantial Benefits Claims Concealed True Financial Position

The court heard that Tatlow systematically claimed pension credits, housing benefit, and council tax reductions over a considerable period without disclosing his actual financial circumstances. Prosecutors detailed how he received £39,821 in pension credits, £26,355 in housing benefit, and £4,363 through council tax reductions – totalling £70,539 of public money.

During sentencing, Judge Huw Rees told the defendant he should be ashamed of his actions as he handed down a 10-month suspended prison sentence. The judge also ordered Tatlow to complete a rehabilitation course and scheduled a proceeds of crime hearing to recover the illicit gains.

Undisclosed Assets Included Welsh Land and Bulgarian Property

Investigations revealed Tatlow owned multiple assets he had deliberately concealed from authorities. These included:

- Land near Llandeilo in Carmarthenshire valued at approximately £160,000

- A holiday home located in Bulgaria

- Additional undisclosed financial assets

Prosecutor Matt Murphy explained that each time Tatlow applied for benefits, he omitted these substantial holdings from his declarations. When confronted about the discrepancies, the pensioner claimed the failure to declare was merely an oversight, a defence the court evidently rejected given the repeated nature of the omissions.

Limited Repayment and Ongoing Recovery Proceedings

The court was informed that Tatlow has so far repaid only £1,083 of the fraudulently obtained funds, with just £85 of that amount going to Swansea Council. This minimal repayment underscores the significance of the upcoming proceeds of crime hearing, which aims to ensure taxpayers recover the substantial sum wrongfully taken.

Defence representatives suggested their client might require assistance with financial management, though this argument did not mitigate the deliberate pattern of deception established through multiple benefit applications.

Broader Context of Benefits System Abuse

This case emerges alongside other significant benefits fraud prosecutions across the United Kingdom. In a separate matter, James Stephen Barley from Paisley admitted to fraudulently obtaining nearly £170,000 in Universal Credit payments by hijacking the identities of 68 individuals.

Barley submitted 157 fraudulent claims over three years using stolen personal details, creating falsified tenancy agreements and bank documents to support his applications. He has since secured legitimate employment earning £700 weekly but faces serious consequences for his systematic deception of the Department for Work and Pensions.

These cases highlight ongoing challenges in preventing sophisticated fraud against the benefits system, particularly when claimants deliberately conceal substantial assets or create elaborate false identities to exploit support mechanisms designed for genuinely vulnerable individuals.