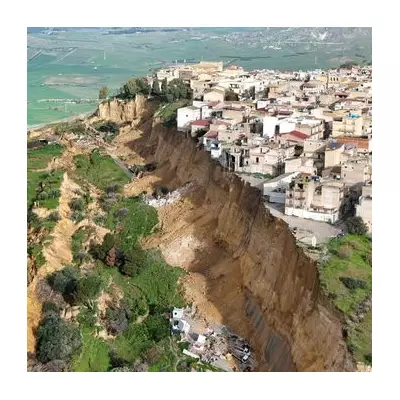

A state-backed Chinese company has emerged as a leading contender to acquire Thames Water, Britain's largest water utility, according to industry reports. The potential takeover comes as the debt-laden firm struggles with financial instability and increasing regulatory pressure.

Thames Water's Financial Woes

Thames Water, which serves 15 million customers across London and the South East, has been grappling with £14 billion of debt and repeated criticism over its environmental performance. The company's financial troubles intensified last year when its parent company defaulted on loans, prompting emergency government discussions about temporary nationalisation.

Chinese Interest in UK Infrastructure

The Chinese firm, whose identity remains undisclosed, is reportedly one of several international investors eyeing Thames Water. This potential acquisition follows a growing trend of Chinese investment in critical UK infrastructure assets, including previous stakes in other water companies and energy networks.

Regulatory Hurdles Ahead

Any deal would require approval from multiple regulatory bodies, including Ofwat, the UK's water regulator, and could face political scrutiny given increasing concerns about foreign ownership of essential utilities. The government has recently expanded its powers to block foreign takeovers of strategically important assets.

What This Means for Consumers

Industry analysts suggest that while new investment could help stabilise Thames Water's finances, customers are unlikely to see immediate changes to their bills or service quality. The long-term impact on infrastructure investment and environmental performance remains uncertain.

The potential sale highlights ongoing challenges in the UK water sector, where several companies are struggling with high debt levels and the need for substantial investment to meet environmental targets.