Legendary filmmaker Francis Ford Coppola has taken out a private loan using a historic San Francisco building he purchased over half a century ago as collateral. This financial move comes in the wake of the severe commercial disappointment of his self-funded passion project, the sci-fi epic 'Megalopolis', which reportedly lost millions.

The Loan and the Landmark: A Financial Lifeline

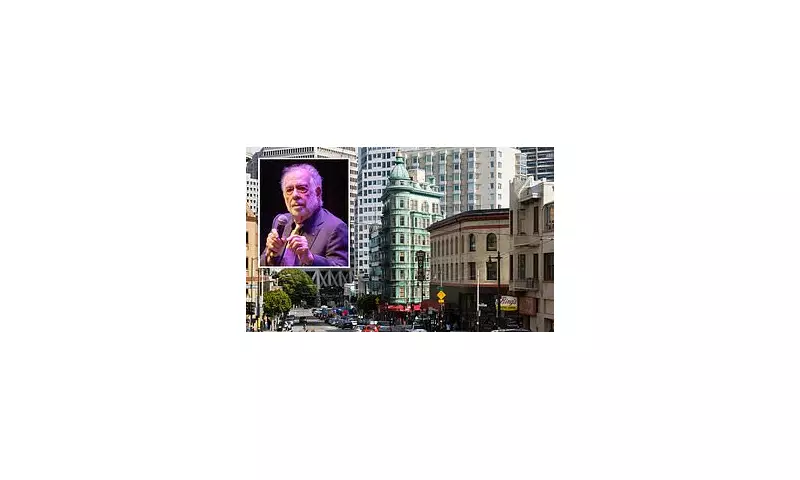

According to reports first published by the San Francisco Chronicle, the 86-year-old director secured the loan from Palo Alto-based Capital Holdings VI LLC last month. The undisclosed sum was granted after Coppola put up the seven-story Columbus Tower, also known as The Sentinel Building, as a guarantee. The exact loan amount and the building's current assessed value were not revealed.

Coppola originally bought the iconic North Beach structure for $500,000 in 1972, flush with the success of his breakthrough film, The Godfather. The building, constructed with a steel frame in 1907 after the great earthquake, was designated a city landmark in 1970. Coppola has long housed the offices of his film studio, American Zoetrope, within its distinctive green copper-clad walls.

The Cost of a Cinematic Dream

The catalyst for this loan is the stark financial fallout from Megalopolis. Coppola invested a staggering $120 million of his personal wealth to bring the film to life. Released in September 2024 and starring Adam Driver and Aubrey Plaza, the movie proved to be a major box office failure, grossing only $14.4 million globally.

The director has been candid about the resulting financial strain. "I don't have any money because I invested all the money that I borrowed to make 'Megalopolis.' It's basically gone," he told producer Rick Rubin earlier this year. In October, he emphasised the need for liquidity to the New York Times, stating, "I need to get some money to keep the ship afloat."

Asset Sales and Alternative Releases

Using Columbus Tower as security is not Coppola's only recent measure to manage debt. Just last month, he sold a private island in Belize for $1.8 million. Furthermore, he is set to auction several high-end watches in December, with individual pieces expected to fetch six or even seven figures.

Concurrently, Coppola is seeking alternative avenues to recoup his investment in Megalopolis. He has released a behind-the-scenes documentary titled 'Megadoc' and has also rolled out a graphic novel adaptation of the film, attempting to build revenue streams beyond the theatrical release.

While the future financial return on his ambitious project remains uncertain, Coppola's use of a beloved personal landmark underscores the profound personal cost of his cinematic vision. The building at the intersection of Columbus Avenue and Kearny Street now stands not only as a symbol of San Francisco's history but also of one director's costly artistic gamble.