In a plot that seems ripped from a techno-thriller, a wealthy British financier and table tennis enthusiast has been unmasked as the alleged mastermind behind a sophisticated cybercrime operation targeting victims across the United Kingdom.

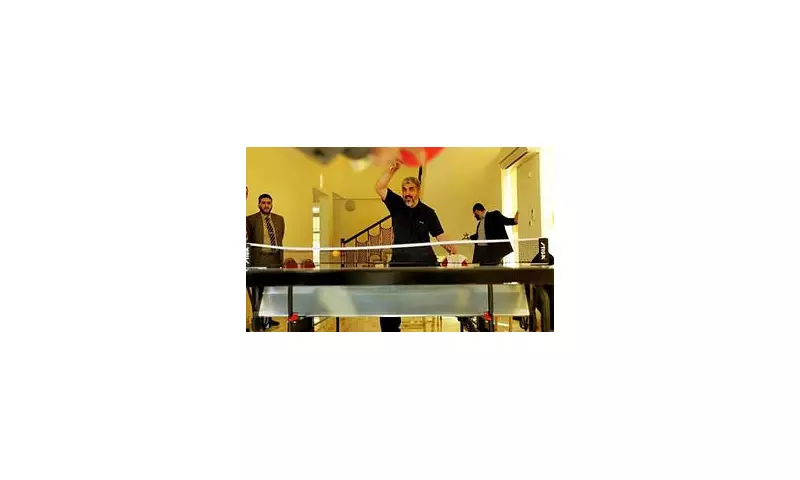

Shezad Chowdhury, a man who moves in elite financial circles and rubs shoulders with celebrities, is accused of orchestrating a devastating phishing campaign, codenamed 'Ping Pong', from his plush Marylebone office. The scheme allegedly siphoned millions from unsuspecting individuals and businesses.

The 'Ping Pong' Phishing Phenomenon

Dubbed the 'Table Tennis Terrorist' by investigators, Chowdhury's operation was far from amateur. It utilised a highly advanced method where victims received seemingly legitimate emails, often mimicking banks or official institutions. Clicking a link would infect their computer, allowing the fraudsters to seize control of their online banking and drain accounts with terrifying speed.

The National Cyber Security Centre (NCSC) and the City of London Police's Cyber Crime unit have linked the 'Ping Pong' campaign to substantial financial losses, making it one of the most damaging phishing operations recently investigated in the UK.

A Life of Luxury and Alleged Crime

The revelation is all the more shocking given Chowdhury's very public profile. He is a known figure in the world of professional table tennis, having sponsored events and players. His company, RPC UK Ltd, operated from a prestigious London address, projecting an image of success and legitimacy.

This facade allegedly concealed his central role in the criminal network. Victims reported being completely wiped out, with life savings disappearing in moments. Despite the severity of the accusations, Chowdhury's activities continued for years, exploiting legal grey areas and the challenges of cross-border cyber policing.

A Web of Deceit and Legal Loopholes

Authorities face an uphill battle. Chowdhury's operations involved a complex web of companies and international transactions, designed to obscure the money trail. His legal team has vigorously denied any wrongdoing, framing the allegations as a misunderstanding of complex financial dealings.

This case has sent shockwaves through the cyber security community, highlighting the evolving threat from highly organised and well-funded criminal enterprises operating within plain sight. It raises urgent questions about the adequacy of current regulations to tackle financially sophisticated cybercriminals who exploit the very systems meant to ensure economic stability.

As the investigation continues, victims are left seeking justice, while experts warn that this case may be just the tip of the iceberg in a new era of white-collar cybercrime.