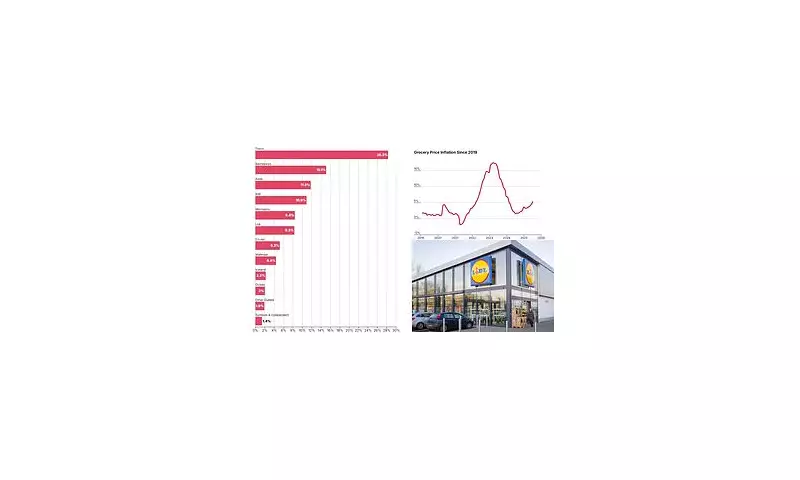

As grocery price inflation continues to shape consumer spending in the UK, new data reveals which supermarkets are winning the battle for shoppers' loyalty—and which are falling behind. July 2025 has brought fresh challenges for retailers, with some adapting better than others.

The Winners: Who's Beating Inflation?

Several major supermarket chains have managed to keep prices competitive despite rising costs. Discount retailers, in particular, have seen a surge in popularity as budget-conscious shoppers seek value for money.

- Lidl and Aldi continue to dominate the discount sector, with aggressive pricing strategies attracting new customers.

- Tesco has successfully leveraged its Clubcard loyalty scheme to retain shoppers.

- Waitrose has maintained its premium appeal while introducing targeted discounts to stay competitive.

The Losers: Who's Feeling the Pinch?

Not all retailers have navigated the inflationary pressures as smoothly. Some mid-range supermarkets are struggling to justify their pricing to consumers.

- Sainsbury's has faced criticism for slower price adjustments compared to rivals.

- Morrisons has seen a dip in footfall as shoppers migrate to cheaper alternatives.

- Co-op, despite its convenience appeal, is losing ground due to higher markups.

What Does This Mean for Shoppers?

With inflation still impacting household budgets, consumers are becoming more selective about where they shop. The rise of price comparison apps and loyalty incentives means retailers must work harder than ever to keep customers.

Experts predict this trend will continue, with discounters likely to gain even more market share unless traditional supermarkets can innovate their pricing strategies.