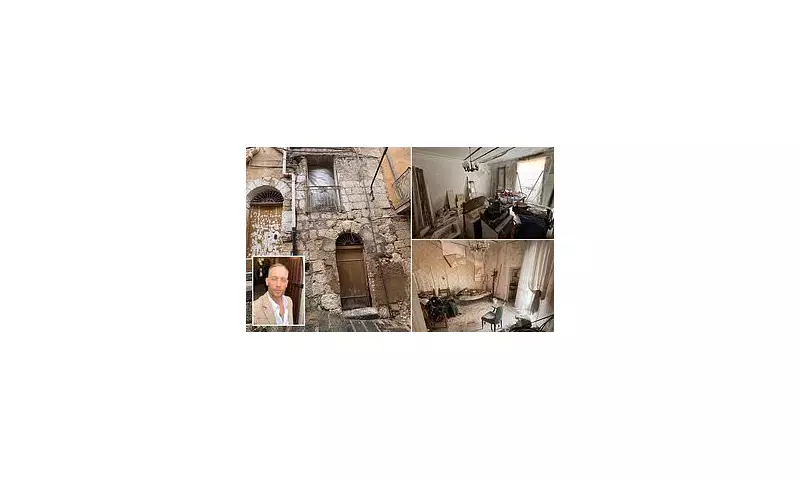

When the Italian town of Mussomeli launched its now-famous €1 home scheme, it sparked a property gold rush among adventurous foreign buyers. But as one British expat discovered, these seemingly miraculous bargains come with strings attached – and costs that quickly add up.

The €1 Dream That Became a €30,000 Reality

Like many, British journalist Sarah Wilson was enticed by the romantic notion of owning a charming Italian home for less than the price of a coffee. What she didn't anticipate was the avalanche of additional expenses that would turn her €1 purchase into a €30,000 project.

Beyond the Purchase Price: The Hidden Costs

- Legal fees: €3,000-€4,000 for contracts and notary services

- Deposit: €5,000 refundable guarantee (required by many towns)

- Renovation bond: Up to €15,000 held until works are completed

- Basic renovations: Minimum €25,000 for livable conditions

Why Italian Towns Are Selling Homes for €1

The scheme isn't just about philanthropy. Depopulated Italian communities use these ultra-cheap homes as bait to attract new residents who will invest in local businesses and revive dying town centers. For buyers, it's a trade-off between low purchase prices and significant renovation commitments.

The Bureaucratic Maze

Wilson describes navigating Italian property bureaucracy as "like doing a PhD in patience." From complex paperwork to language barriers and ever-changing regulations, the process tests even the most determined buyers.

Is It Worth It? The Expat Verdict

Despite the challenges, Wilson remains positive about her Italian adventure. "When I sit on my terrace watching the sunset over the Sicilian hills," she says, "the paperwork headaches fade away." But she cautions: "This isn't for the faint-hearted or those watching their euros."

The €1 home dream lives on – but as Wilson's experience shows, prospective buyers should budget at least €30,000-€50,000 to turn these bargain properties into comfortable homes.