A profound and growing divergence is defining the Australian property landscape, creating a tale of two distinctly different housing markets. Fresh data from leading analysts at CoreLogic paints a picture of robust growth in some capitals, starkly contrasted by stagnation in others.

Sydney's property market is charging ahead with remarkable momentum. The city's dwelling values surged an impressive 1.5% in just the month of August, propelling the median house value to a staggering $1,394,181. This relentless growth places Sydney on a clear trajectory to smash previous price records, potentially as soon as next month.

In a surprising twist, Brisbane has emerged as a powerhouse of growth, even outpacing its southern rivals. With a monthly increase of 1.7%, Brisbane's property market is demonstrating exceptional strength and resilience, capturing the attention of investors and homeowners alike.

Meanwhile, Melbourne presents a far more subdued story. The city managed a mere 0.3% growth in August, a figure that pales in comparison to its eastern counterparts. This sluggish performance has left Melbourne's median dwelling value lagging significantly below its previous peak, creating a clear market disadvantage.

The Driving Forces Behind The Divide

Property experts point to several key factors creating this national imbalance. A significant supply shortage across many markets is colliding with sustained demand, particularly from upsizers and investors seeking opportunities.

Tim Lawless, Research Director at CoreLogic, highlights the critical role of listing volumes: "We're seeing advertised supply remain noticeably low. This is creating a sense of urgency among buyers and is a primary catalyst for price growth, especially in markets like Sydney where demand is particularly concentrated."

The performance gap between houses and units continues to widen nationally. Houses are significantly outperforming units, reflecting a clear buyer preference for space and land content in the post-pandemic era.

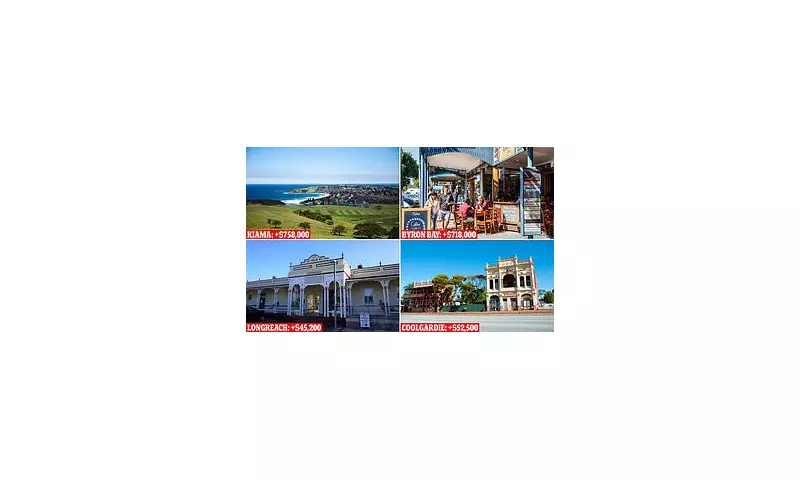

Regional Markets Hold Their Ground

Beyond the capital cities, regional markets are demonstrating remarkable stability. Combined regional areas posted a solid 0.6% growth in August, slightly outpicking the combined capitals growth rate of 0.9%. This suggests that the appeal of regional living, which surged during the pandemic, continues to hold strong.

As spring approaches, traditionally the busiest season for real estate, all eyes will be on whether this two-tiered market continues to develop. The critical question remains: will Melbourne find its footing and join the growth party, or will the gap between Australia's largest cities continue to widen?