House prices across the UK have shown a dramatic regional divide, according to the latest figures from the Office for National Statistics (ONS). While Northern Ireland recorded the strongest annual growth at 4%, London suffered the steepest decline, with prices falling by 4.8% over the past year.

Regional Variations in the UK Housing Market

The ONS data highlights significant disparities in property performance across the country:

- Northern Ireland leads with prices rising by 4% to £192,000

- Scotland saw a 2.2% increase, reaching £194,000

- Wales experienced modest growth of 1.2% to £220,000

- England showed marginal growth of 0.3%, with prices averaging £305,000

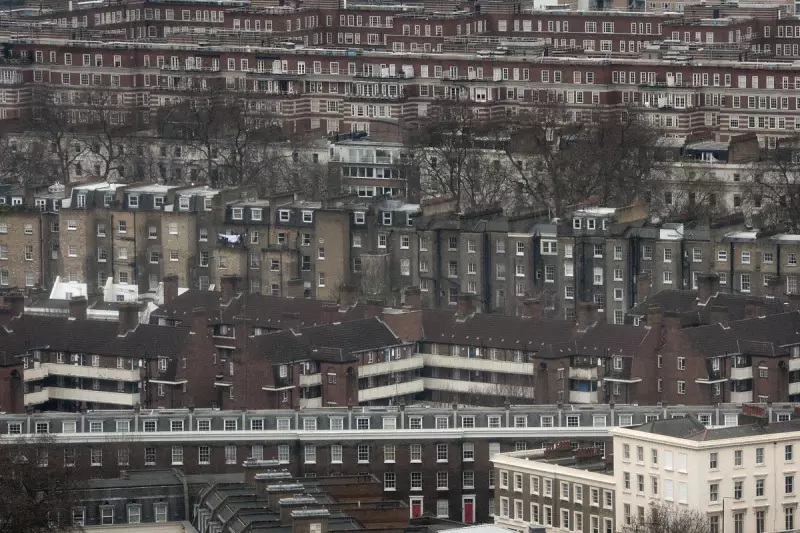

London's Property Market Slump

The capital continues to struggle, with house prices falling by 4.8% year-on-year - the largest decline of any UK region. The average London property now costs £501,000, though this remains significantly higher than the national average.

Other English Regions Show Mixed Results

Outside London, the picture varies across England:

- The North West saw the strongest growth at 2.4%

- Yorkshire and The Humber followed with a 1.7% increase

- The South West was the only English region outside London to see prices fall (-0.6%)

What's Driving These Trends?

Property experts suggest several factors are influencing these regional variations:

- Affordability: Buyers are increasingly priced out of London and looking to more affordable regions

- Remote work: The shift to hybrid working has reduced the need to live near city centres

- Interest rates: Higher mortgage costs are impacting expensive markets more severely

- Investor sentiment: London's premium properties are particularly sensitive to economic uncertainty

The ONS figures, based on completed housing transactions, provide the most comprehensive picture of the UK property market. With interest rates expected to remain high in the near term, these regional disparities may persist through 2024.