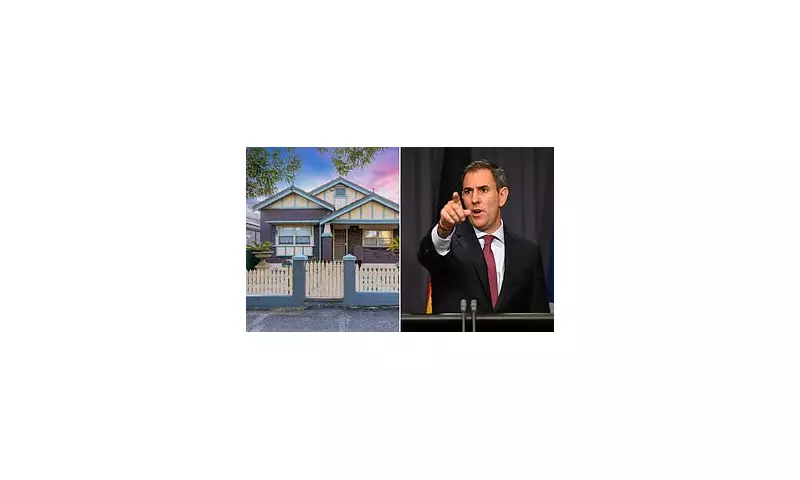

A shocking proposal to impose capital gains tax on the family home in Australia has triggered widespread backlash, with experts warning it could cripple middle-class families and destabilise the housing market.

The Controversial Plan

Under the radical scheme, homeowners could be forced to pay tax on the profits made from selling their primary residence—a move that would mark a dramatic shift in Australia’s property tax system.

Why It’s Sparking Outrage

Critics argue that taxing the family home would unfairly punish ordinary Australians, many of whom rely on property as their primary source of wealth. "This is a direct attack on the aspirations of hardworking families," one economist warned.

Who Could Be Affected?

- Homeowners selling properties bought decades ago at much lower prices

- Families relying on property sales to fund retirement

- Middle-class Australians with modest homes in now-valuable areas

The Political Fallout

The proposal has become a political lightning rod, with opposition leaders vowing to fight what they call "the worst kind of housing tax." Meanwhile, supporters claim it could help address housing affordability by discouraging property hoarding.

What Happens Next?

As the debate intensifies, all eyes are on Canberra to see if the government will proceed with this politically risky reform. For now, Australian homeowners are left wondering: could their family home suddenly become a tax liability?