Trainline investors were thrown into turmoil on Friday as the company's share price suffered a catastrophic 20% collapse following the Labour Party's general election victory.

The dramatic sell-off, which wiped nearly £300 million from the firm's market value, was directly triggered by Labour's manifesto commitment to establish Great British Railways (GBR) as a new state-owned body that would become the primary operator for rail ticketing and sales.

Market Reaction and Analyst Warnings

Financial analysts were quick to sound the alarm, with several major institutions issuing stark warnings about Trainline's future prospects under the new government framework. The company's stock plummeted to 346.4p in morning trading, marking one of the worst performances on the FTSE All-Share index.

"This represents an existential threat to Trainline's business model," noted Holly Williams, Assistant Editor at the Independent. "Investors are clearly pricing in significant disruption to their operations once GBR becomes the dominant player in rail ticketing."

Labour's Transport Revolution

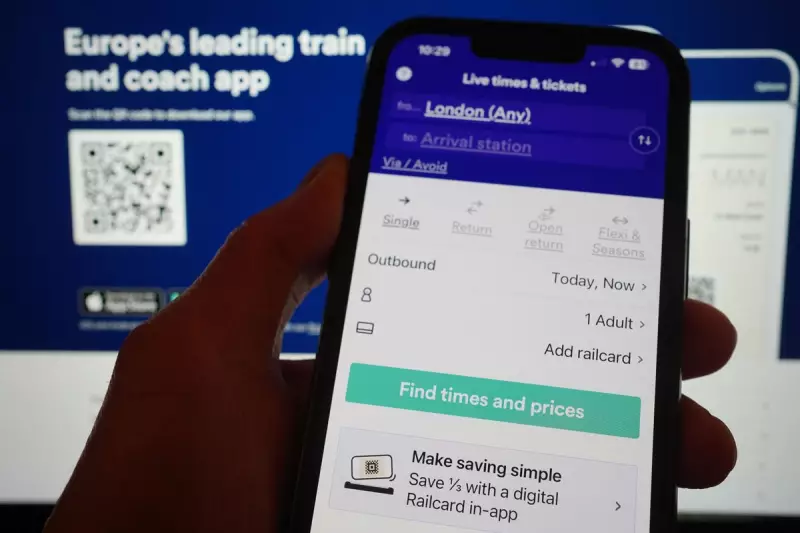

The incoming Labour government has made no secret of its plans to overhaul Britain's rail network. The creation of Great British Railways forms a cornerstone of their transport policy, aiming to simplify what many passengers describe as a confusing and fragmented ticketing system.

Key aspects of the plan include:

- Establishing a single, publicly-owned ticketing platform

- Integrating operations across the national rail network

- Potentially reducing commission fees for third-party sellers

- Creating a unified customer experience across all rail services

What This Means for Passengers and Investors

While the government's plans promise simpler ticketing for passengers, the financial markets have delivered a brutal verdict on what this means for private operators. Trainline, which has built its business on taking commission from ticket sales, now faces an uncertain future competing against a state-backed alternative.

The scale of Friday's sell-off suggests investors believe the company will struggle to maintain its market position and profitability once Great British Railways becomes operational. All eyes will now be on how Trainline's management responds to this seismic shift in the UK's transport policy landscape.