Asian markets experienced a significant downturn on Tuesday, reacting to sobering comments from US Federal Reserve Chairman Jerome Powell that dashed hopes for near-term interest rate cuts.

The sell-off was led by Japan's benchmark Nikkei 225 index, which fell sharply as the yen strengthened against the dollar following Powell's steadfastly hawkish tone. His remarks, made during a conference, signalled that the American central bank needs to see more convincing evidence that inflation is sustainably returning to its 2% target before considering any policy easing.

Powell's Firm Stance Dampens Trader Optimism

Speaking to an audience of central bankers, Powell stated that "the recent data have clearly not given us greater confidence" that inflation is under control. He emphasised that "it is likely to take longer than expected to achieve that confidence," suggesting that the current restrictive policy stance will be maintained for an extended period.

This message directly countered the prevailing optimism on Wall Street, which had closed mixed but relatively steady. The stark contrast in reaction highlights the heightened sensitivity of Asian markets to US monetary policy and the global flow of capital.

Tokyo Takes the Brunt of the Sell-Off

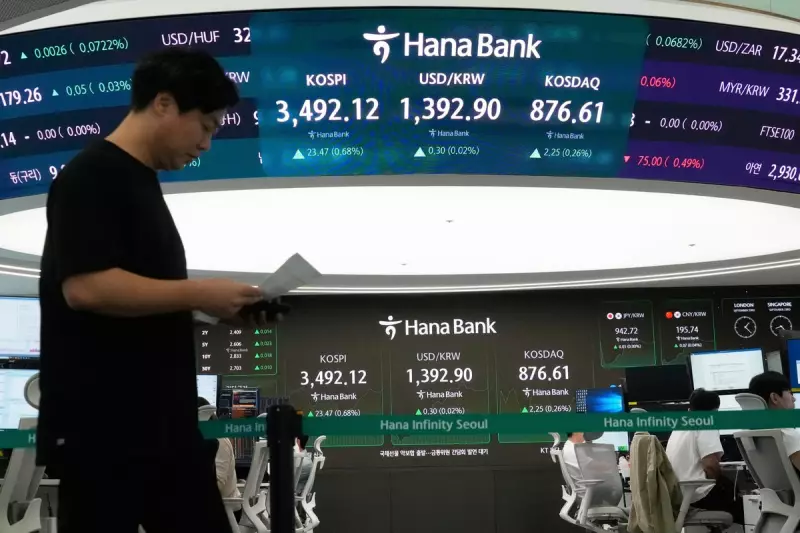

The impact was most acutely felt in Tokyo. A stronger yen, which weighs on the profitability of Japan's major export-driven companies, acted as a catalyst for the Nikkei's decline. Hong Kong's Hang Seng index and markets in South Korea and Australia also registered notable losses.

Analysts suggest that Powell's comments have forced a rapid recalibration of market expectations. The prevailing narrative has now shifted from "when" the first rate cut will occur to "if" it will happen at all this year. This uncertainty is creating volatility and driving investors towards safer assets.

With the Federal Reserve holding its ground, global markets are bracing for a prolonged period of high US interest rates, a scenario that continues to attract investment away from emerging markets and strengthens the US dollar globally.