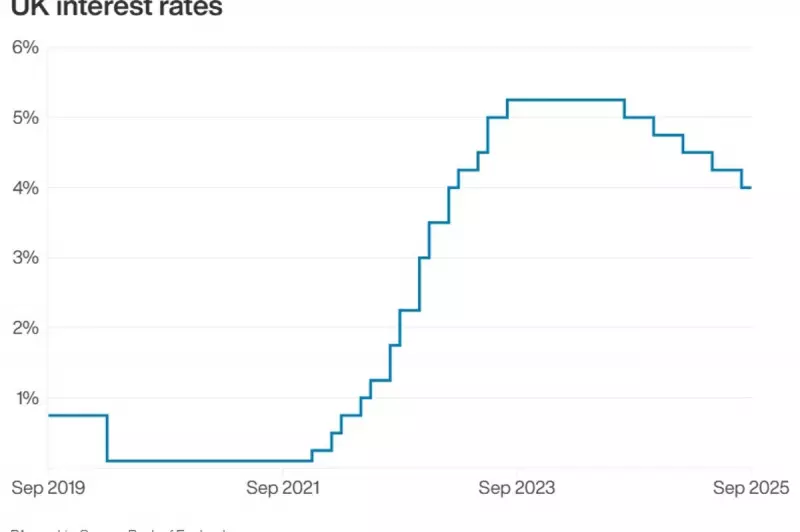

The Bank of England has held UK interest rates steady at 5.25% for another month, maintaining its cautious stance amid ongoing economic uncertainty. In a significant move that caught markets' attention, the Monetary Policy Committee also announced it would accelerate its quantitative tightening (QT) programme.

Quantitative Tightening Accelerates

The central bank revealed plans to increase its bond-selling efforts, boosting the target from £90bn to £100bn over the coming year. This aggressive unwinding of the massive stimulus measures implemented during the pandemic era signals the Bank's confidence in tackling persistent inflation while managing economic stability.

Bailey's Cautious Tone

Governor Andrew Bailey struck a measured tone in his accompanying statement, emphasising that "the last mile of inflation reduction remains challenging". While acknowledging recent positive economic indicators, he cautioned that the MPC needs to see "more conclusive evidence" that inflationary pressures are sustainably returning to the 2% target.

Market Reaction and Economic Implications

Financial markets had largely priced in today's decision, with analysts divided on when the first rate cut might materialise. The accelerated QT programme suggests the Bank is walking a tightrope between controlling inflation and avoiding excessive tightening that could stifle economic growth.

What This Means for Households and Businesses

- Mortgage holders: No immediate relief from high borrowing costs

- Savers: Continued relatively attractive returns on savings accounts

- Businesses: Investment decisions likely to remain cautious

- Pound: Sterling stability expected amid predictable policy

The Bank's decision reflects the delicate balancing act facing policymakers as they navigate between persistent inflationary pressures and growing concerns about economic growth. All eyes now turn to the next MPC meeting for signals about potential future rate movements.