The Department for Work and Pensions has announced a significant escalation in its efforts to combat fraud and error within the benefits system, with new legislative powers now in effect. Senior officials have detailed plans to implement rigorous checks on banking information and enforce direct recoveries from accounts where overpayments are identified.

Enhanced Scrutiny for Key Benefits

Under the updated regulations, the DWP will initially focus its enhanced verification procedures on recipients of Universal Credit, Pension Credit, and Employment and Support Allowance. The department has confirmed that these measures could be extended to cover other benefits in the future, reflecting a broader strategy to safeguard public funds.

Direct Recovery Powers Activated

A pivotal aspect of the new framework grants investigators the authority to directly deduct money from a claimant's bank account if they are found to owe funds to the DWP and refuse to cooperate with repayment requests. This move is designed to streamline the recovery process and reduce administrative burdens.

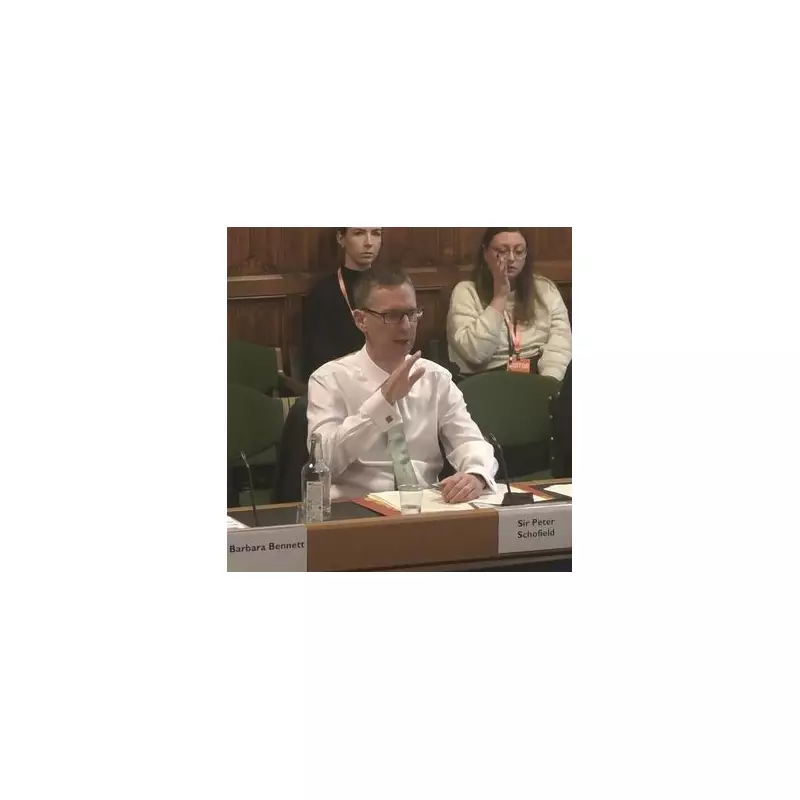

DWP Permanent Secretary Peter Schofield addressed the Work and Pensions Committee, emphasising that tackling fraudulent and wrongful payments remains "a big focus" for the department. He revealed that a dedicated team is operating "at full pelt" on targeted case reviews, aiming to identify and halt incorrect disbursements.

Substantial Investment in Fraud Prevention

The initiative is backed by approximately £300 million in funding for the current financial year, which supports around 4,000 agents tasked with investigating potential cases of fraud or error. Mr Schofield reported that this investment has already contributed to a notable reduction in the percentage of wrongful Universal Credit payments over the past two years.

Human Oversight Assured

Despite employing advanced machine learning algorithms to flag suspicious claims, the DWP has assured that all final decisions regarding benefit suspensions are made by human agents. Mr Schofield explained: "In our fraud and error work, we don't stop any benefits without a human looking at this, reviewing all the evidence, from all sorts of different sources that they've got, including understanding markers of vulnerability or complex needs as well, and then making a decision off the back of that."

Proactive Measures to Prevent Errors

In addition to reactive investigations, the department is implementing proactive steps to minimise incorrect payments from the outset. This includes issuing reminders to claimants to promptly report any changes in their circumstances, such as updates to household composition or financial status.

A specific example highlighted involves children over the age of 16; claimants are urged to inform the DWP if these dependents remain in full-time education or training, as this can affect benefit entitlements. Currently, additional payments for children are available until they turn 16, or until 19 if they continue in approved education, with amounts varying based on birth dates and the number of children.

Changes to Child Benefit Caps

It is important to note that the existing two-child limit, which restricts extra payments to the first two children in a household, is set to be abolished from April 2026. This follows Chancellor Rachel Reeves's announcement in the Autumn Budget 2025, marking a significant policy shift under the current government.

The DWP's reinforced approach underscores a commitment to fiscal responsibility while maintaining support for legitimate claimants, ensuring that the benefits system operates with greater accuracy and integrity.