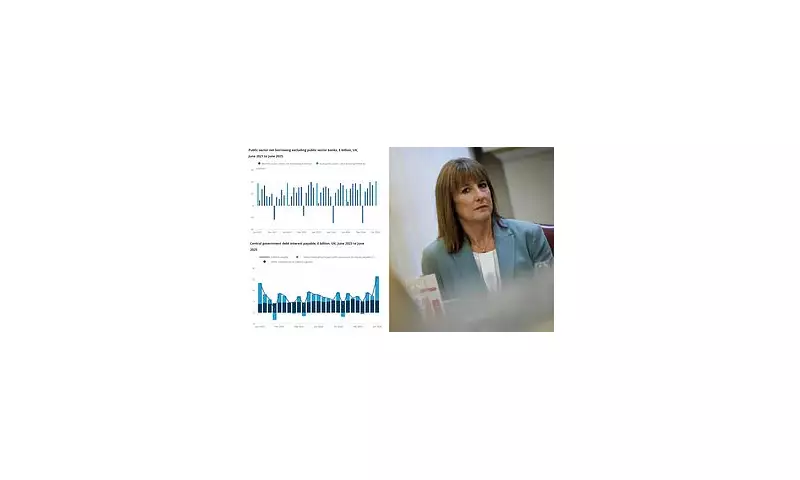

The UK government's borrowing has surged to a record high outside of the Covid-19 pandemic, raising alarms over the state of public finances and fuelling speculation about impending tax rises.

New figures reveal that public sector net borrowing reached £16 billion in June – more than double the £7.5 billion recorded during the same month last year. This marks the highest June borrowing since records began in 1993, excluding pandemic years.

Debt Burden Grows Under New Chancellor

The worrying statistics represent the first major test for Chancellor Rachel Reeves, who inherited a challenging economic landscape when Labour took office earlier this month. The figures show debt interest payments alone cost £8.2 billion in June, highlighting the growing burden of servicing the national debt.

Key Concerns for Households and Businesses

- National debt now stands at 99.8% of GDP

- Debt interest payments up £0.5 billion year-on-year

- Tax receipts show signs of weakening economic activity

Economists warn that the deteriorating fiscal position could force the government to consider tax increases or spending cuts to stabilise public finances. The Office for Budget Responsibility had previously forecast borrowing of £19.8 billion for June, meaning the actual figure came in £3.8 billion below expectations.

What This Means for UK Taxpayers

The unexpected borrowing surge has intensified debate about how the new government will address the fiscal shortfall. With debt levels approaching 100% of GDP, financial markets will be watching closely for signs of how Chancellor Reeves plans to restore balance to the public finances.

While lower than forecast, the borrowing figures still represent a significant challenge for policymakers. The government faces difficult choices between maintaining public services, investing in growth, and ensuring fiscal sustainability – decisions that could have major implications for households and businesses across the country.