Chancellor Rachel Reeves is preparing to unleash what critics are calling a "brutal assault" on millions of workers, savers and pensioners through extended stealth taxes in the upcoming Budget.

The Treasury chief appears set to maintain the controversial freeze on tax thresholds for an additional two years, despite recently abandoning unpopular plans to increase income tax rates directly.

The Stealth Tax Strategy

This prolonged freeze represents a significant revenue-raising measure for the government, expected to generate more than £8 billion annually towards closing a substantial financial shortfall estimated between £30 billion and £40 billion.

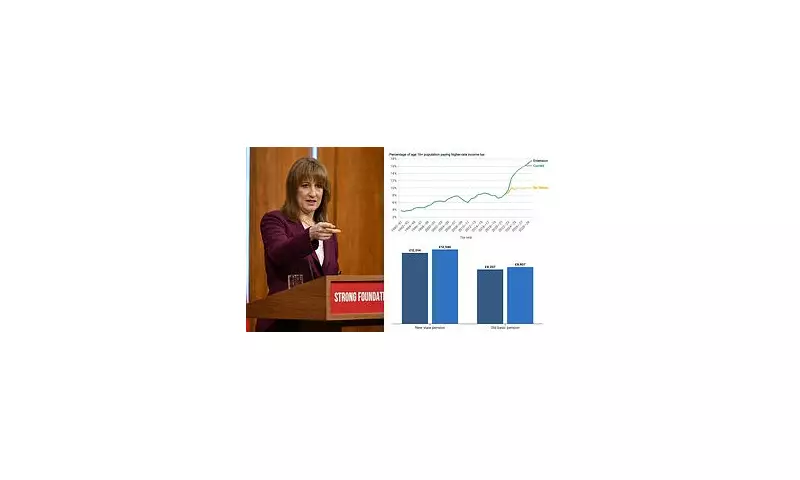

While avoiding the political embarrassment of overt tax hikes, the policy carries severe consequences for British taxpayers. By allowing inflation and wage growth to push people into higher tax brackets without adjusting thresholds, more than 10 million people will find themselves paying the top rate of tax by 2030.

The Institute for Fiscal Studies reveals that nearly one in five workers will be dragged into paying 40% or higher tax rates on their income. Middle-class professionals including senior nurses, police officers and teachers will be particularly affected.

Pensioners and Low Earners Hit Hardest

For the first time in history, all pensioners will face tax on their full state pension in the 2027-28 tax year, creating a situation where the state effectively gives with one hand while taking with the other.

Meanwhile, lower-income workers won't escape unscathed. A full-time employee earning minimum wage will see their annual tax bill increase by £137 compared to current policies that adjust thresholds with inflation.

The IFS analysis shows that in 2022-23, just under half of those receiving the full new state pension were taxpayers. Without policy changes, every pensioner will become a taxpayer by 2027-28, potentially requiring them to complete tax declarations to HMRC.

Broader Financial Implications

Extending the threshold freeze, originally implemented by Rishi Sunak in 2021, for two additional years until April 2030 would net the Treasury £8.3 billion in that year alone. This comes on top of the £42 billion the policy was already projected to raise by 2027-28 when it was scheduled to end.

Government sources attribute last week's reversal on income tax increases to slightly improved economic forecasts from the Office for Budget Responsibility. However, Ms Reeves still faces the challenge of addressing a fiscal gap of up to £40 billion while committed to rebuilding financial "headroom" depleted by abandoned policies like benefits cuts.

Economists express concern that the Chancellor may now pursue a "smorgasbord" of smaller tax increases to resolve her financial predicament. These likely include a new gambling levy, increased taxes on expensive properties, and per-mile charges for electric vehicles.

Treasury officials have downplayed the possibility of outright threshold reductions but acknowledge the need to employ "big levers" to raise necessary funds, with final decisions expected in the coming days.