Chancellor Rachel Reeves is confronting a financial conundrum as Britain's benefits system prepares for a substantial uplift next spring, with welfare payments expected to surge by 3.8% while the state pension could leap by an even more significant 4.8%.

The Spending Squeeze

Whitehall insiders reveal the Treasury is actively exploring measures to rein in public expenditure as these automatic increases threaten to strain the nation's finances. The Chancellor finds herself walking a political tightrope between honouring manifesto commitments and implementing fiscal responsibility.

Pension Power Surge

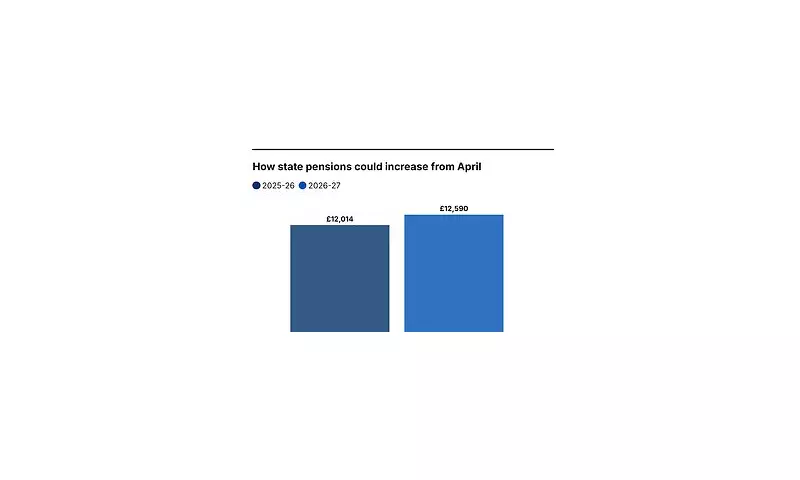

The state pension's projected 4.8% increase, driven by the government's triple lock mechanism, would represent one of the most substantial boosts in recent years. This policy guarantees pensions rise by the highest of three measures: average earnings growth, inflation, or 2.5%.

Benefits Uplift Analysis

Meanwhile, the 3.8% rise in general benefits follows the traditional September inflation figure, creating a complex financial landscape for the Treasury. Departmental officials are reportedly working overtime to identify potential savings across government without breaking key electoral promises.

Political Pressure Mounts

The situation presents a significant challenge for the Labour government, which must balance its social commitments with economic realities. Critics are already questioning how the administration will fund these increases while maintaining its pledge of fiscal discipline.

With April's increases now appearing inevitable, all eyes remain on Reeves and her team as they navigate one of their first major economic tests in government.