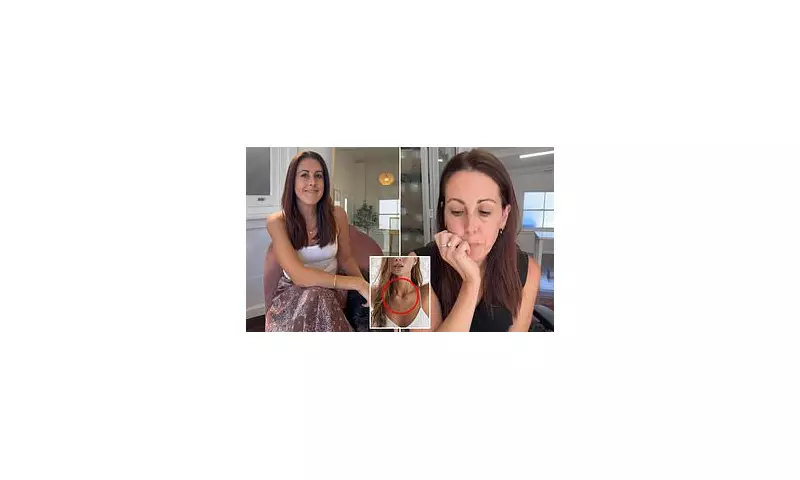

An Australian entrepreneur has sent shockwaves through the small business community after revealing how she fell victim to a sophisticated chargeback scam orchestrated by social media influencers. The business owner's emotional TikTok video has gone viral, exposing what many are calling a disturbing new trend in digital commerce.

The Costly Deception

The nightmare began when multiple influencers placed substantial orders from her online store, only to later dispute the charges through their banks. "I was absolutely devastated," the business owner confessed in her viral video. "These weren't small orders - we're talking hundreds of dollars worth of products that they received, used, and then claimed they never got."

How the Chargeback Scam Works

The scheme exploits the financial system's chargeback protection, which is designed to protect consumers from fraudulent transactions. Influencers are allegedly:

- Placing legitimate orders and receiving the products

- Waiting until the return window closes before filing disputes

- Claiming unauthorized transactions or non-receipt of goods

- Keeping the products while receiving full refunds

The Devastating Impact on Small Businesses

For independent retailers, the consequences are severe. Not only do they lose the products and revenue, but they also face additional chargeback fees from payment processors. "The fees alone can cripple a small business," the owner explained. "We're not talking about massive corporations here - these are real people trying to make a living."

Fighting Back and Raising Awareness

Since sharing her story, the business owner has been inundated with messages from other retailers who've experienced similar situations. Her courage in speaking out has sparked an important conversation about:

- The need for better protection for small businesses

- Increased awareness about chargeback abuse

- Ethical responsibilities of influencers

- Banking system reforms

The viral response has created a support network for affected business owners and is putting pressure on financial institutions to address what many see as a growing problem in the e-commerce landscape.