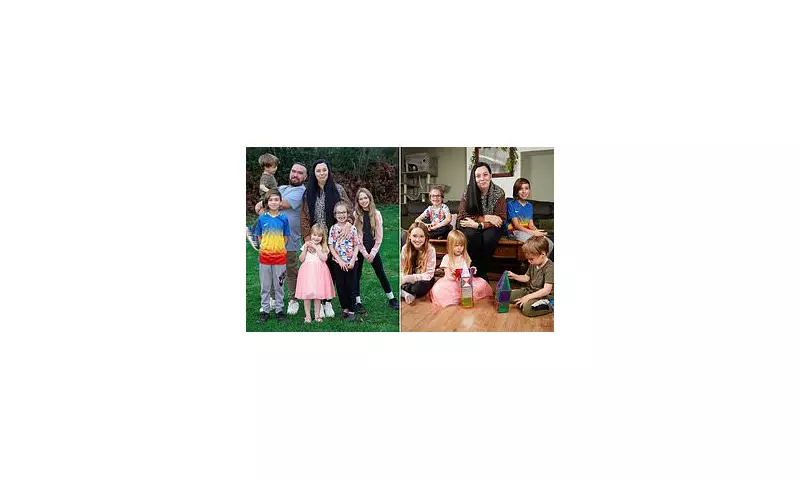

The unmistakable signs of a bustling family home greet visitors to Lisa and David White's Monmouth property long before crossing the threshold. Bicycles scattered across the lawn and the constant soundtrack of children's laughter signal this is anything but a child-free zone.

The Daily Reality of a Five-Child Household

Behind the front door of their four-bedroom housing association home in south Wales, the hallway transforms into a maze of miniature coats and trainers. With five children aged between three and ten, all born within seven years, Lisa White describes family life as "very, very busy".

While the 6am starts present their own challenges, the 31-year-old mother identifies financial pressure as the greater burden. Neither she nor her partner David, 35, currently works, making their household among the nearly 200,000 large families anticipating significant increases in state support.

Benefits System Under Scrutiny

The Whites' circumstances changed dramatically when David experienced a mental health crisis after witnessing COVID-related deaths while working as a carer in a dementia care home. His £456 weekly income vanished when he left employment in 2022, coinciding with Lisa's pregnancy with their fifth child.

Currently, the family receives £1,935 monthly in benefits payments, exceeding the standard child benefits limit because David qualifies for disability support. Their £560 monthly rent is covered separately, bringing their total annual state support to £29,940.

Lisa addresses common assumptions head-on: "I think there is a misconception because everyone who looks at me with five children says: 'She's obviously doing it for the benefits.' But we made that decision to have five children when our financial position was completely different."

Policy Shift Brings Financial Relief

Chancellor Rachel Reeves recently stated that children shouldn't be "penalised for being in bigger families through no fault of their own," signalling the likely removal of the two-child benefits cap in the November 26 Budget. Introduced by Conservative chancellor George Osborne in 2017, the policy limits Universal Credit and Child Tax Credit payments to the first two children.

The anticipated change could see five-child families like the Whites becoming £10,000 annually better off, at an estimated cost of £3.5 billion to the Treasury. Department for Work and Pensions figures indicate approximately 470,000 families are affected by the current policy.

Lisa describes the potential impact on her family: "It would definitely make a difference to the kids. I'd be able to treat them if I wanted to. I'd be able to take them for days out."

The family maintains careful budgeting, shopping at Lidl and avoiding luxuries. Their first holiday was a £58 off-season break at Butlin's in Minehead earlier this year. Lisa dyes her own hair and hasn't visited a salon since her middle child's pregnancy.

Regarding her children's circumstances, Lisa reflects: "I don't think of my children as living in poverty. We have a roof over our heads, we have gas and electricity and I'm able to go food shopping every week." However, she acknowledges buying second-hand clothes and missing out on certain opportunities.

With one child attending school part-time and David unable to care for the children alone, Lisa's plans to return to work remain on hold. She expresses mixed feelings about their situation: "I love being at home with the kids. But at the same time I'd love to be able to go and work and have a bit of time for myself. It would be nice to have my own identity as well."

As the national debate around welfare spending intensifies, Lisa acknowledges that parental decisions contribute to pressure on public finances, but adds: "This is the tiniest part of the picture. I'm sure there is a lot more contributing to it than just us seven."