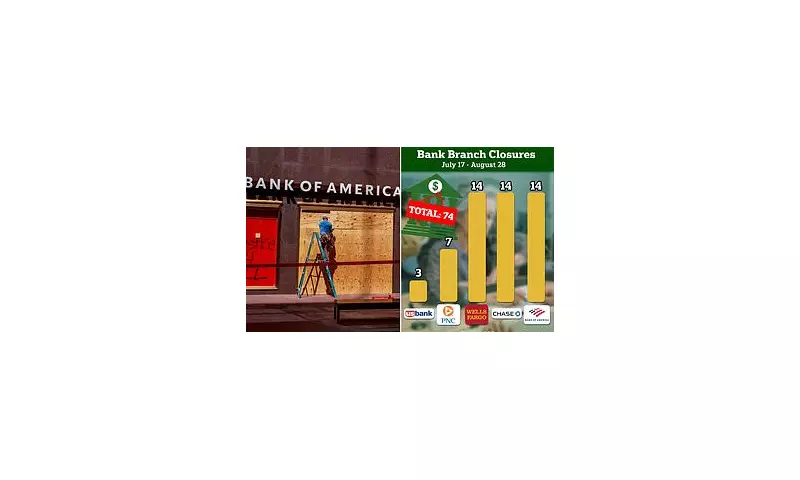

The UK's high streets have been dealt another brutal blow, as major banks have shuttered a staggering 74 branches in just over a month. This rapid retreat from physical banking has left many communities, particularly the elderly and vulnerable, facing a future without local financial hubs.

The closures, which occurred between July and September, represent one of the most intense waves of shutdowns in recent memory. The move has sparked outrage among consumer groups and charities, who warn of the devastating impact on those reliant on face-to-face banking services.

Who's Closing and Where?

The cuts have been widespread, affecting customers of nearly all major high street players:

- Lloyds Banking Group (including Lloyds and Halifax) was the most aggressive, closing 21 sites.

- Barclays followed closely, shutting down 18 of its branches.

- NatWest Group (including NatWest and Royal Bank of Scotland) closed 17 locations.

- HSBC UK completed 11 shutdowns.

- Ulster Bank closed 7 branches.

The closures have not been confined to one region. Dozens of towns and cities across England, Scotland, and Wales have been affected, creating 'banking deserts' where residents must travel significant distances for in-person services.

The Human Impact: Beyond the Bottom Line

While banks cite a dramatic shift to online banking as the primary reason, campaigners argue this ignores a significant portion of the population. Age UK and other charities highlight that over four million elderly people are not regular internet users, effectively cutting them off from essential financial services.

Local businesses also suffer, losing a key footfall driver that brings customers into town centres. The disappearance of a bank often has a ripple effect, leading to further decline for other high street shops.

The Banking Industry's Defence

Banks maintain that they are simply following customer behaviour. With over 80% of current account holders now using digital apps or online platforms, the footfall in many branches has plummeted to unsustainable levels.

In response to criticism, banks often promote their 'banking hub' initiatives and enhanced Post Office services, which allow for basic transactions. However, critics argue these alternatives cannot fully replace the expertise and range of services offered by a dedicated branch, especially for complex matters like mortgages, loans, or fraud support.

This mass closure spree signals a fundamental and irreversible shift in the UK's banking landscape, leaving many to wonder about the future of financial inclusion for all.