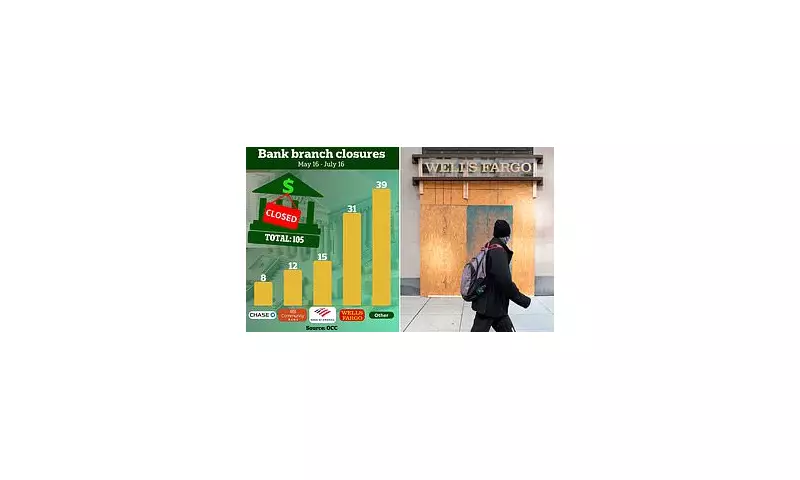

In a bold move reflecting the rapid digital transformation of the financial sector, major US banks—including Chase and Wells Fargo—are shutting down hundreds of branches nationwide. The trend highlights a growing reliance on online banking and a push to cut operational costs.

Why Are Banks Closing Branches?

The banking industry is undergoing a seismic shift as customers increasingly favour mobile apps and online services over traditional in-person visits. Chase and Wells Fargo, two of America's largest banks, have confirmed significant reductions in their physical networks.

Chase Leads the Downsizing Trend

Chase, owned by JPMorgan, has closed dozens of branches this year alone, with plans to shutter even more. The bank insists that the move is part of a strategic shift towards digital-first banking, where most transactions can be completed via smartphones or computers.

Wells Fargo Follows Suit

Similarly, Wells Fargo has been aggressively trimming its branch network, citing cost-saving measures and changing customer behaviour. The bank has faced regulatory scrutiny in recent years, making efficiency a top priority.

What Does This Mean for Customers?

While digital banking offers convenience, the closures raise concerns for customers who rely on in-person services, particularly the elderly and small businesses needing cash transactions. Some communities may face reduced access to banking services altogether.

The Future of Banking

Experts predict that branch closures will continue as banks invest heavily in AI-driven customer service and cybersecurity. The question remains: will digital banking fully replace the need for physical branches, or will a hybrid model emerge?