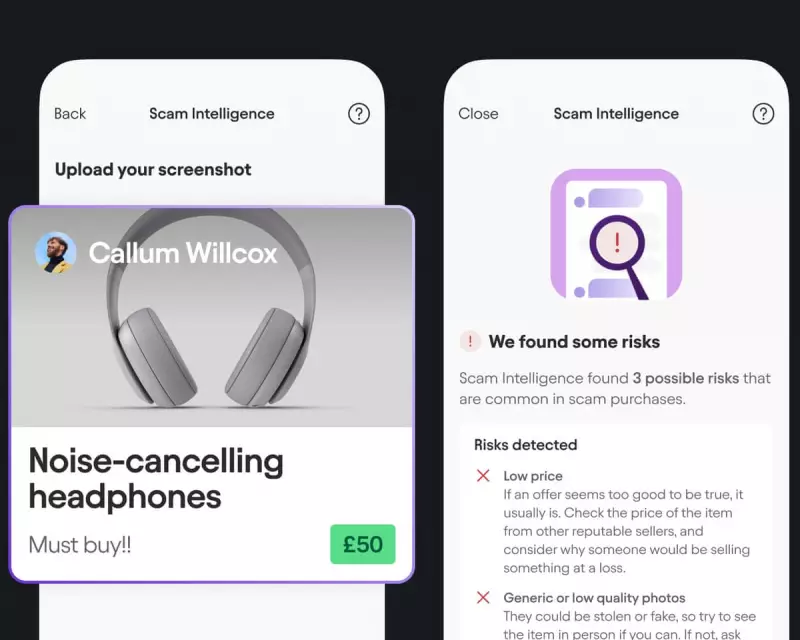

In a groundbreaking move against the rising tide of online fraud, Starling Bank has deployed sophisticated artificial intelligence technology that's already preventing millions in potential losses for British consumers. The digital bank's new defence system specifically targets scams originating from popular online platforms including Facebook Marketplace, eBay, Vinted, and Etsy.

The Scale of the Problem

UK consumers have faced an unprecedented wave of sophisticated scams in recent years, with fraudsters exploiting the trust-based nature of peer-to-peer marketplaces. According to recent data, purchase scams account for nearly two-thirds of all authorised push payment fraud cases, making them the most common type of fraud in Britain.

"We're seeing criminals become increasingly sophisticated in their methods," explained a Starling Bank security analyst. "They create convincing fake listings, impersonate genuine sellers, and use psychological pressure to rush victims into making payments without proper checks."

How the AI Defence System Works

Starling's technology employs multiple layers of protection:

- Real-time transaction monitoring: The AI analyses payment patterns and flags suspicious transactions before they're processed

- Platform recognition: The system identifies payments destined for known marketplace platforms and applies additional scrutiny

- Behavioural analysis: Machine learning algorithms detect unusual spending patterns that might indicate scam activity

- Instant alerts: Customers receive immediate warnings when attempting payments to high-risk recipients

Early Success Stories

The system has already demonstrated remarkable effectiveness in its initial rollout. One customer was prevented from sending £1,200 for what appeared to be a luxury watch on Facebook Marketplace - an item that investigation revealed didn't exist.

Another user was stopped from completing a £850 payment for concert tickets on a fake reseller site that mimicked the legitimate vendor's appearance.

"The technology doesn't just look at individual transactions in isolation," the Starling representative noted. "It understands context, recognises patterns across our entire customer base, and learns from every attempted scam to improve its detection capabilities."

The Human Element

Despite the advanced technology, Starling emphasises that human oversight remains crucial. Suspicious transactions flagged by the AI are reviewed by security specialists who can place temporary holds on payments while they contact customers directly.

This combination of artificial intelligence and human expertise creates a powerful defence network that adapts to emerging threats in real-time.

Industry Implications

Banking analysts suggest that Starling's proactive approach could set a new standard for fraud prevention across the UK financial sector. As scams become more sophisticated, traditional reactive measures are proving insufficient.

Other major banks are now closely monitoring Starling's results, with several reportedly developing similar AI-driven solutions to protect their own customers.

The success of this technology highlights the growing importance of artificial intelligence in financial security and may accelerate adoption across the banking industry.