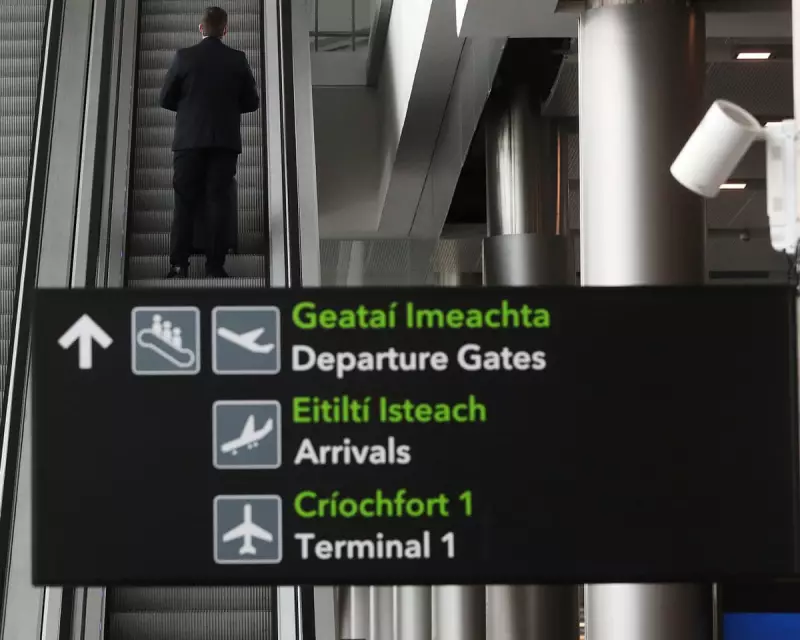

Dozens of Northern Irish families are facing devastating child benefit cuts in a controversial UK government crackdown that's using travel through Dublin Airport as evidence of non-residency.

The HM Revenue and Customs (HMRC) has implemented new automated checks that flag families who've travelled via the Republic of Ireland, treating their journeys as proof they no longer live in the United Kingdom.

The Dublin Loophole: How Travel Patterns Trigger Benefit Suspensions

Under the new system, any Northern Irish resident travelling through Dublin Airport risks triggering automated alerts that question their UK residency status. Many families use Dublin for cheaper flights or better connections, particularly when visiting family in Europe or further afield.

One Belfast mother described receiving a letter stating her child benefit would stop immediately because HMRC had "reason to believe" she no longer lived in the UK. "I've never lived anywhere but Northern Ireland," she said. "But because we visited family in Spain via Dublin, they're treating us as if we've emigrated."

Families Face Financial Crisis Amid Bureaucratic Battle

The sudden loss of payments, which can amount to over £1,000 per year per child, has left many families in financial distress. Parents now face a complex appeals process requiring extensive documentation to prove they haven't moved abroad.

- Proof of Northern Ireland residence

- Children's school enrollment records

- Utility bills and council tax documents

- Employment records and payslips

"We're being punished for geography," said another parent from Derry. "Dublin is our closest international airport. Using it doesn't make us any less Northern Irish."

Political Fallout and Legal Challenges Mount

The policy has sparked political outrage across Northern Ireland, with politicians from multiple parties condemning the approach as fundamentally misunderstanding the reality of life on the island of Ireland.

Cross-border advocacy groups are preparing legal challenges, arguing the automated system fails to account for the unique circumstances of Northern Irish citizens and their legitimate travel patterns.

An HMRC spokesperson stated the system is designed to ensure benefits only go to UK residents, but campaigners argue the implementation is causing unnecessary hardship for legitimate claimants.

As the controversy grows, affected families are calling for immediate reform of what they describe as a blunt and discriminatory system that penalises them for their location within the United Kingdom.