The future of Britain's largest water company hangs in the balance after a dramatic showdown with its regulator. Thames Water's plea for a 40% increase in customer bills has been formally rejected by Ofwat, pushing the debt-laden utility closer to the brink of a temporary government takeover.

A £19 Billion Debt Mountain

At the heart of the crisis is a staggering £15.2 billion debt pile, a figure that balloons to over £19 billion when accounting for derivatives and other financial instruments. This massive financial burden has severely hampered Thames Water's ability to fund critical infrastructure projects and sewage system upgrades.

Despite the rejection, Ofwat has permitted a more modest average increase of 23% over the next five years. However, this falls far short of the company's demands, leaving a significant funding gap for essential modernisation works.

The Spectre of Special Administration

The company's financial viability is now under intense scrutiny. With shareholders refusing to inject the promised £500 million of fresh equity and Ofwat blocking the proposed bill increases, the government's 'special administration' regime appears increasingly likely.

This would see temporary public control of the company, ensuring the taps keep running for Thames Water's 16 million customers across London and the South East. While ministers insist this would be a last resort, preparations are understood to be well advanced behind the scenes.

Customers and Communities Bear the Brunt

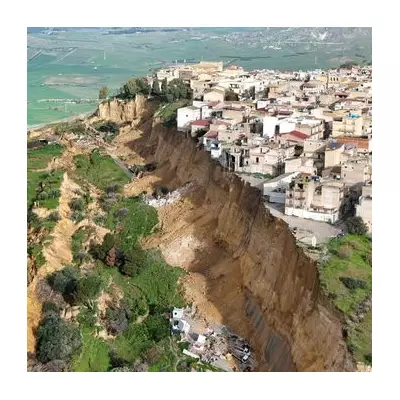

The ongoing uncertainty has left customers in a precarious position. While the immediate threat of soaring bills has been averted, the fundamental issues of leaky pipes and sewage discharges into rivers and seas remain unresolved.

The company's performance has been heavily criticised, with frequent sewage spills and water leakage rates drawing public outrage. This crisis represents a critical test for the privatised water industry model, raising questions about its sustainability and accountability to the public it serves.

All eyes are now on Thames Water's next move as it navigates one of the most challenging periods in its history, with the livelihoods of millions and the health of the nation's waterways at stake.