The future of Britain's largest water company hangs in the balance after the industry regulator delivered a devastating verdict on its survival plan.

Ofwat has outright rejected Thames Water's plea to hike customer bills by 40% and to be let off the hook for hundreds of millions of pounds in penalties for its poor performance, including rampant sewage spills. This decision significantly increases the likelihood that the beleaguered utility will require a government rescue.

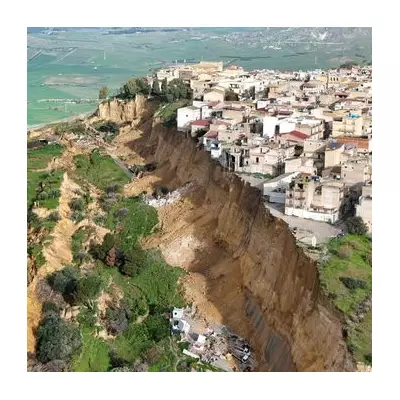

On the Precipice of Collapse

The company, staggering under an enormous £15.2 billion debt pile, had presented a business plan that was contingent on Ofwat's approval. The regulator's dismissal of this plan is a monumental setback, stripping Thames Water of its proposed financial lifeline and pushing it closer to the brink of a formal collapse into special administration.

Such a move would see the government step in to temporarily take over the company to ensure the taps of its 16 million customers keep running, in what would be the most significant failure in the sector since its privatisation.

A Catalogue of Failures

Ofwat's criticism was scathing. The regulator found the company's business plan to be "unaffordable" for consumers and "lacking in ambition" on critical issues. Thames Water has consistently ranked as one of the worst-performing companies in the country.

Its record is marred by:

- Excessive sewage discharges into rivers and waterways.

- Persistent water leakage from its ageing pipe network.

- Failing infrastructure leading to supply interruptions.

- Poor customer service levels.

Ofwat stated that customers should not be asked to pay for the company's past failures and operational shortcomings.

What Happens Next?

With its central recovery plan in tatters, Thames Water's options are rapidly diminishing. Its parent company has already declared it will not provide further funding, leaving the utility isolated.

The focus now shifts to Whitehall and the Department for Environment, Food and Rural Affairs (DEFRA), which has a "water resilience team" actively preparing for a potential temporary nationalisation. The government has repeatedly stated its position: no bailouts for the company's shareholders. The looming question is no longer if the company will fail, but when.