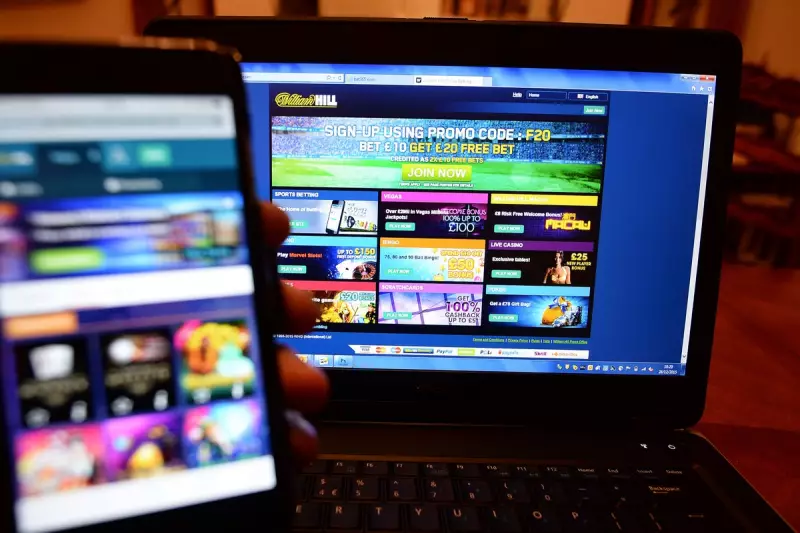

Evoke, the parent company of prominent betting brands William Hill and 888, is moving forward with a series of shop closures and substantial cost-reduction measures. This decisive action comes as a direct response to the financial pressures imposed by recent government adjustments to gambling taxation, announced in Chancellor Rachel Reeves' November Budget.

Budget Announcement Spurs Industry Reaction

The Chancellor's Budget detailed significant increases in gambling duties, which have sent shockwaves through the sector. From April next year, the remote gaming duty will rise sharply from 21 per cent to 40 per cent. Furthermore, a new online sports betting duty of 25 per cent is scheduled to be introduced from 2027, adding another layer of financial burden for operators.

Evoke's Strategic Assessment and Financial Forecast

Per Widerstrom, the Chief Executive of Evoke, voiced clear disappointment with the government's decision. He warned that these tax hikes could have a detrimental effect on the legitimate gambling industry, potentially driving customers towards unregulated and illegal black markets. In light of these challenges, Evoke is now thoroughly evaluating its strategic options to navigate this altered fiscal landscape.

The company had previously issued stark warnings about the potential consequences of the new duties. It estimated that its annual costs could surge by as much as £135 million starting in 2027. As part of its contingency planning, Evoke suggested that up to 200 of its retail locations might face closure, a threat it is now beginning to enact.

Financial Performance Amidst Uncertainty

Despite these headwinds, Evoke's financial outlook shows a mixed picture. The company reported a 4 per cent decrease in its fourth-quarter revenues compared to the same period last year. However, for the full year, it anticipates a modest revenue increase of approximately 2 per cent, projecting total revenues to reach around £1.79 billion.

The market reaction to the announcement of these operational changes was notably negative. Evoke's shares experienced a significant drop, falling by 7 per cent following the news, reflecting investor concerns over the company's future profitability in the face of heightened taxation.

This development underscores the ongoing tension between government policy aimed at regulating the gambling sector and the operational realities faced by major industry players. The closures and cost-cutting measures represent a tangible outcome of the Budget's fiscal policies, with wider implications for employment, retail presence, and market competition within the UK's gambling industry.