Global Markets Rocked by AI Investment Fears

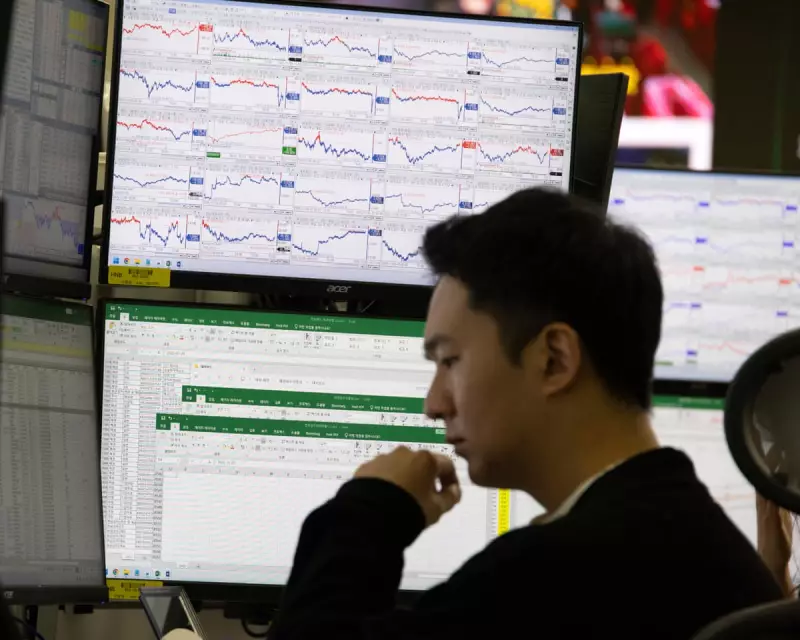

Financial markets worldwide have been thrown into turmoil as a sharp sell-off gripped trading floors, driven by mounting concerns that the artificial intelligence sector has become dangerously overvalued.

The dramatic downturn saw billions wiped from company valuations across major indices, with technology stocks bearing the brunt of the selling pressure. Investors are increasingly questioning whether the AI boom that has powered market gains for months has reached unsustainable levels.

London and European Markets Hit Hard

In London, the FTSE 100 suffered one of its worst trading sessions this year, mirroring heavy losses across European markets. The panic spread rapidly from Wall Street to Asian trading hubs, creating a perfect storm of negative sentiment.

"What we're witnessing is a classic market correction after a period of excessive optimism," explained one City analyst. "The AI revolution is real, but valuations had become detached from reality."

Warning Signs Ignored

Financial experts point to several worrying indicators that suggested trouble was brewing:

- Sky-high valuations for AI-focused companies with minimal revenue

- Massive investment flowing into unproven AI technologies

- Traditional valuation metrics being largely ignored by investors

- Growing regulatory concerns about AI development and implementation

The sell-off reflects growing anxiety that the AI sector may be repeating the patterns of previous technology bubbles, where excitement outpaced actual business fundamentals.

What Comes Next for Investors?

Market analysts are divided on whether this represents a temporary correction or the beginning of a more sustained downturn. Some see this as a healthy market adjustment, while others fear it could trigger broader economic consequences.

The key question now is whether this sell-off will spread to other sectors or remain contained within the technology and AI space. With central banks already grappling with inflation concerns, the timing of this market turbulence couldn't be worse for policymakers.

As one veteran trader noted: "When everyone is crowded into the same trade, the exit door suddenly looks very small. That's exactly what we're seeing unfold today."