Entertainment

Rachel Zoe Reveals Shocking Proposal After Infidelity Confession on RHOBH

Fashion designer Rachel Zoe shares intimate details of her marriage breakdown with Rodger Berman on Real Housewives, including a proposal after she confessed to fooling around with a model.

Sports

Influencer Hannah Brooke's Bittersweet Farewell to New York After NFL Trade

Influencer Hannah Brooke expresses mixed emotions as fiancé Jermaine Johnson trades from Jets to Titans, marking a family move to Nashville with gratitude for New York memories.

Politics

Badenoch Blames Labour's 'Grievance Politics' for By-Election Defeat

Kemi Badenoch accuses Labour of creating a 'monster' of Muslim bloc voting that cost them a safe seat, as dirty tricks allegations marred the Gorton and Denton by-election campaign.

Crime

Two Teenagers Arrested After Man Stabbed Near Sydney's Bondi Beach

Two teenage boys, aged 15 and 17, have been charged following a violent stabbing incident near Bondi Beach in Sydney. The 54-year-old victim remains in serious but stable condition in hospital.

Business

Health

Weather

LA Hits Record Heat After Winter Storm, NWS Issues Warnings

Los Angeles experiences unprecedented high temperatures of 91°F in late February, breaking daily records after severe winter storms caused flooding and avalanches.

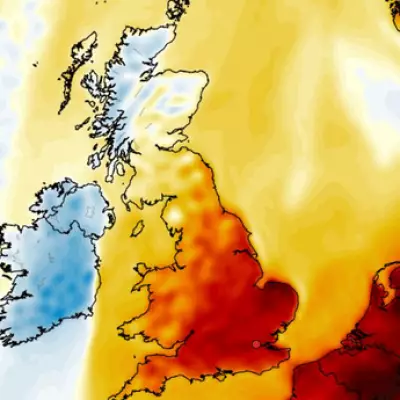

UK March Weather: Balmy Temperatures and Sunshine Forecast

The Met Office predicts above-average temperatures and high pressure for early March, with highs of 17°C in eastern England, though cooler conditions persist in the north.

Clocks Spring Forward in March 2026: Sleep Loss Looms

The clocks will go forward on March 29, 2026, marking the start of British Summer Time. This change brings lighter evenings but costs an hour of sleep, with the return to GMT set for October 25, 2026.

Security Expert Reveals How to Deter Luggage Thieves

Former US Army military policeman Ed Burnett shares crucial tips on luggage security, from color choices and tracking tech to packing strategies and danger zones, to protect your belongings while traveling.

March Blizzard Forecast to Hit UK Cities as Temperatures Drop

Advanced weather maps reveal a surprise blizzard could sweep across England, Wales, Northern Ireland and Scotland on March 14, bringing snow to major urban areas.

Tech

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam

Environment

UK Geography Weekend Special

Weekend special: 100 questions about UK geography. Perfect for students preparing for exams or anyone who loves learning about Britain's diverse landscapes.